Hi @support,

The community forum has been quiet for awhile. Hope all is well.

Anyway, I don't believe the system is capturing my algo since the go live for the competition.

It seems static & flat, quite possibly because of the external lib for the Hurst exponent.

https://quantiacs.com/statistic/1464900

Can you have a look pls when you get a free moment.

Thanks.

Sheikh

Best posts made by Sheikh

-

RE: Strategy Fundingposted in General Discussion

-

RE: Strategy Fundingposted in General Discussion

@support

Appreciate the response, thanks, yes you're right. -

RE: Q16 where to put is_liquid in ML templateposted in Strategy help

Hi @support,

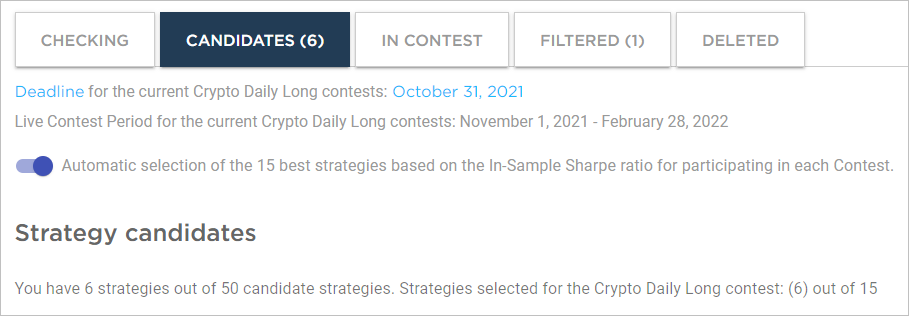

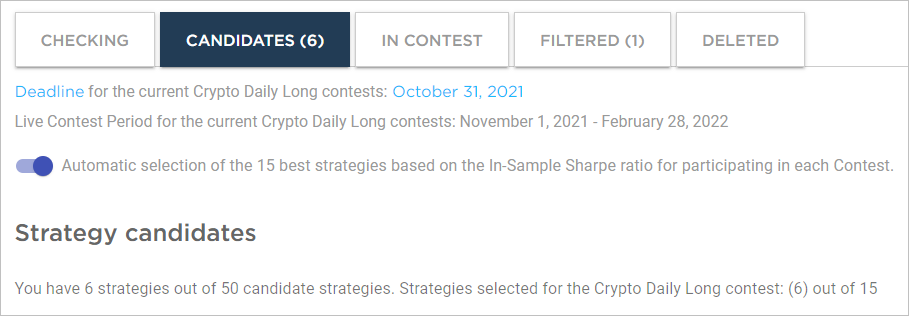

Thanks for getting back. No worries, I was able to get 6 strategies into the Q16 competition so far.

-

RE: Trading Bitcoin on Weekendsposted in News and Feature Releases

@news-quantiacs

But I want to trade only the BTC Futures. And I want to be able to backtest my BTC Futures algo on Quantiacs.

This change has disrupted all of my BTC Futures algos.It is not realistic to trade the Bitcoin spot in the real world marketplace:

- In order to start trading Bitcoin spot, investors must first set up a digital wallet with online platforms such as Coinbase or Kracken. This process can be difficult for the non tech-savvy or those unfamiliar with the crypto landscape.

- Account Security Concerns: Web-based cryptocurrency exchanges are potentially more susceptible to technical errors and security concerns than well-established & regulated financial hubs such as the Chicago Mercantile Exchange.

- Tax Challenges: Due to the nature of cryptocurrency and how it is treated for tax purposes, complications can arise when processing taxes on crypto gains & losses.

It is easier and more realistic to trade the BTC Futures:

Trading BTC futures affords the same ease-of-access as other derivative products from the CME. Existing futures traders can seamlessly start trading BTC futures.Also you cannot short the Bitcoin currency spot. So a Bitcoin currency spot algo can only go Long.

Please watch this video

https://ninjatrader.com/blog/why-trade-bitcoin-futures-vs-the-spot-market/You made a change that affects quants who do NOT want a change. Maybe you should think about having both options: BTC Futures and Bitcoin spot.

Please re-instate the BTC Futures also.

Thanks. -

Cryptocurrency algos issuesposted in Support

Hi @support,

I believe something has gone wrong with the cryptocurrency algos on your Quantiacs system.-

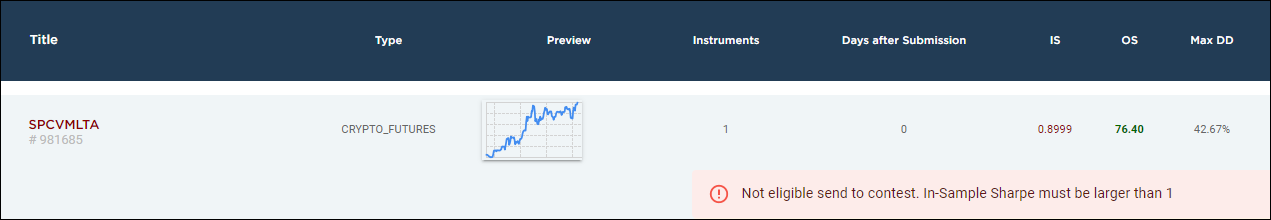

The top 30 algos on your Leaderboard are all Futures strategies. Not a single crypto algo is in your top 30. The cryptos have all dropped to the bottom. Several of the backtest Sharpe Ratios for cryptocurrency algos are showing as less than 1 even though they had to score greater than one to get into the competition. Something is not looking right.

-

Yesterday, I submitted a cryptocurrency algo using the ML VotingClassifier. It had a backtest Sharpe Ratio of 2.41 and made $440M in seven years. This is a copy of the chart when it was accepted to the contest yesterday Sunday:

Today, when I checked it on the Leaderboard, the backtest SR is less than 1. And in my account, it is stating that it is ineligible for the competition even though it was already accepted to the competition with an SR = 2.41 yesterday. And the OS Sharpe is 76.40 for 1 live day. That is just crazy.

Actually, now all of my cryptocurrency algos have a backtest SR of less than 1 even though they were accepted to the competition.

Please have a look.

Thanks.

-

-

Files disappeared from online envposted in Support

Hi @support ,

2 jupyter notebook files I was working on last night disappeared from my online jupyter env.

Last night I was working on:- esmultifeatrc-Copy2-improved

- pairsstate

Today they are no longer there.

I work in the Quantiacs online env.

Can you look into pls.

Thanks.

Latest posts made by Sheikh

-

RE: Strategy Fundingposted in General Discussion

Hi @support,

If you don't mind, I have a couple of questions with respect to another discussion in the forum that's going on.- What do the rules mean by:

"... an all-time new high profit level must be achieved before further incentive fees will be payable ..."

I understand the investor losses should be recouped first, but I didn't follow the part about "... an all-time new high profit level must be achieved before... "? - Also, during the phase 3 real trading for winners as you described it:

Are we allowed to make updates/refreshes to the strategy during the one year period, such as to re-optimize parameters, e.g. threshold parameters, indicator lookback, etc?

Thanks.

Sheikh

- What do the rules mean by:

-

RE: Q16 where to put is_liquid in ML templateposted in Strategy help

Hi @support,

Thanks for getting back. No worries, I was able to get 6 strategies into the Q16 competition so far.

-

RE: Q16 where to put is_liquid in ML templateposted in Strategy help

Hi @support

Why does the competition filter say the 'in sample period is too short: 781 < 1696'?

My strategy is starting from start_date= "2014-01-01" which is the same as the start date in your crypto daily template.INFO: 2021-07-11T20:02:46Z: pass started: 2396972 INFO: 2021-07-11T20:03:08Z: pass completed: 2396972 INFO: 2021-07-11T20:03:16Z: stats received light=false INFO: 2021-07-11T20:03:16Z: progress: 1.0 INFO: 2021-07-11T20:03:16Z: checking: last pass INFO: 2021-07-11T20:03:16Z: filter passed: source exists INFO: 2021-07-11T20:03:16Z: filter passed: output html exists INFO: 2021-07-11T20:03:16Z: filter passed: output exists INFO: 2021-07-11T20:03:16Z: filter passed: strategy uses the last data INFO: 2021-07-11T20:03:16Z: filter passed: liquidity INFO: 2021-07-11T20:03:16Z: filter passed: positions >= 0 FAIL: 2021-07-11T20:03:16Z: filter failed: in sample period is too short:781 < 1696Please look into when you have a moment.

Thanks.

Sheikh -

Q16 where to put is_liquid in ML templateposted in Strategy help

Hi Support,

Please advise where to put the is_liquid statement in the ML template for the Q16 competition?

Thanks. -

RE: Stocks strategyposted in Strategy help

@support

How are you guys coming along with the Equity data?

Thanks.

Sheikh -

RE: Strategy Fundingposted in General Discussion

@support

Appreciate the response, thanks, yes you're right. -

RE: Strategy Fundingposted in General Discussion

Hi @support,

The community forum has been quiet for awhile. Hope all is well.

Anyway, I don't believe the system is capturing my algo since the go live for the competition.

It seems static & flat, quite possibly because of the external lib for the Hurst exponent.

https://quantiacs.com/statistic/1464900

Can you have a look pls when you get a free moment.

Thanks.

Sheikh -

Please help to convert to work on Futures datasetposted in Support

Hello @support,

I was wondering if I can request your assistance in converting the code below to work on the Futures dataset. (I omitted & changed a few things to not reveal the true strategy. But this is the basic idea.)

It currently works on the Crypto dataset.

I'm posting the crypto version as the attempts I made to convert it to work on Futures are a big mess.

Basically, I changed the load_data and competition type to futures and removed the markets = ['BTC'] line.

I also removed from the output: dims=['asset'], coords=dict(asset=markets)

But still no luck getting it to run on Futures.

Can you take a look pls when you have a moment.

Thanks.import xarray as xr import numpy as np import qnt.data as qndata import qnt.backtester as qnbt import qnt.ta as qnta def load_data(period): data = qndata.cryptofutures_load_data(tail=period) return data def strategy(data, state): markets = ['BTC'] zthreshold = 2.0 lookback_trading_days = 20 close = data.sel(field='close') last_close = close.isel(time=-1) high = data.sel(field='high') low = data.sel(field='low') # state may be null, so define a default value prev_output = state if prev_output is None: prev_output = xr.zeros_like(last_close) s1 = close[-lookback_trading_days:] # Compute mean of the spread up to now mvavg = np.mean(np.log(s1)) # Compute stdev of the spread up to now stdev = np.std(np.log(s1)) # Compute current spread current_spread = np.log(s1[-1]) # Compute z-score zscore = (current_spread - mvavg) / stdev if stdev > 0 else 0 output = prev_output if prev_output == [1] and zscore[-1] <= -zthreshold: output = [0] elif prev_output == [-1] and zscore[-1] >= -zthreshold: output = [0] elif zscore[-1] <= zthreshold: output = [1] elif zscore[-1] >= -zthreshold: output = [-1] else: output = prev_output return xr.DataArray(output, dims=['asset'], coords=dict(asset=markets)), output weights, state = qnbt.backtest( competition_type="cryptofutures", lookback_period=200, # lookback in calendar days start_date= "2014-01-01", strategy=strategy, analyze=True, build_plots=True, collect_all_states=False # if it is False, then the function returns the last state, otherwise - all states ) -

RE: How are models ranked on the leaderboard before the live period?posted in General Discussion

@support

oh I see now what you mean.

15 strategies PER USER are selected.

At first, I thought you were only going to select 15 strategies total for all users.

Thanks. -

RE: How are models ranked on the leaderboard before the live period?posted in General Discussion

@support

Only 15 strategies are selected for the Live competition?