@vyacheslav_b Thank you for your response

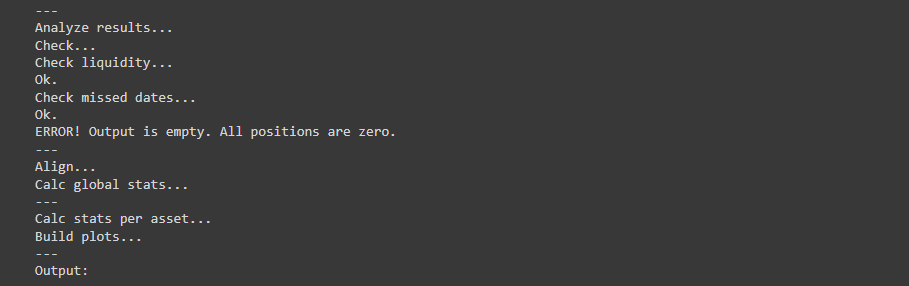

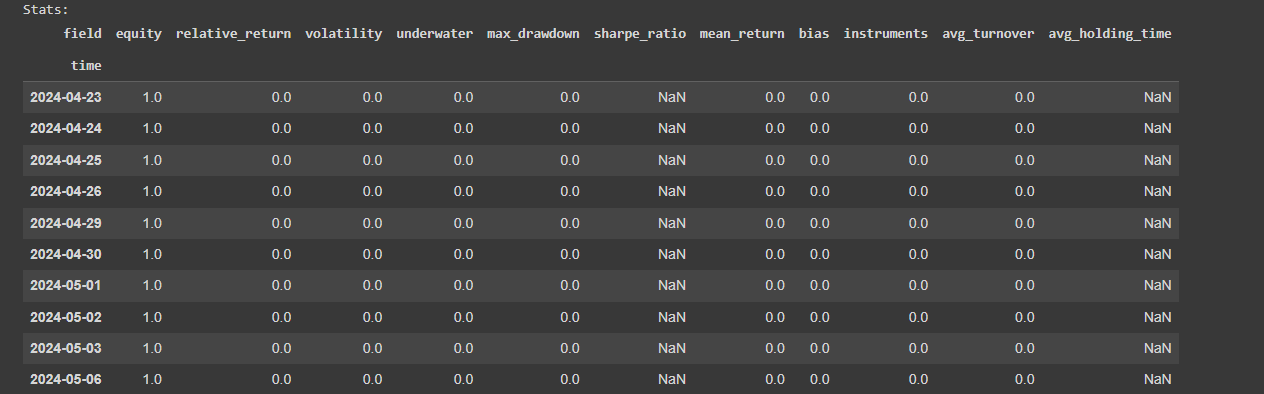

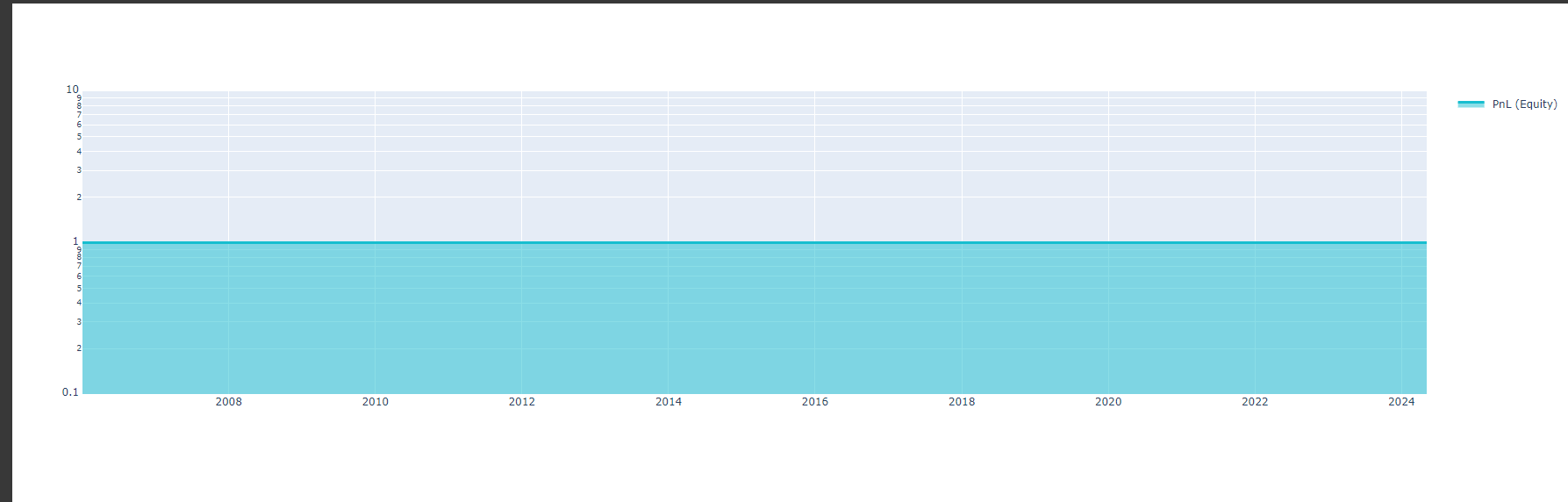

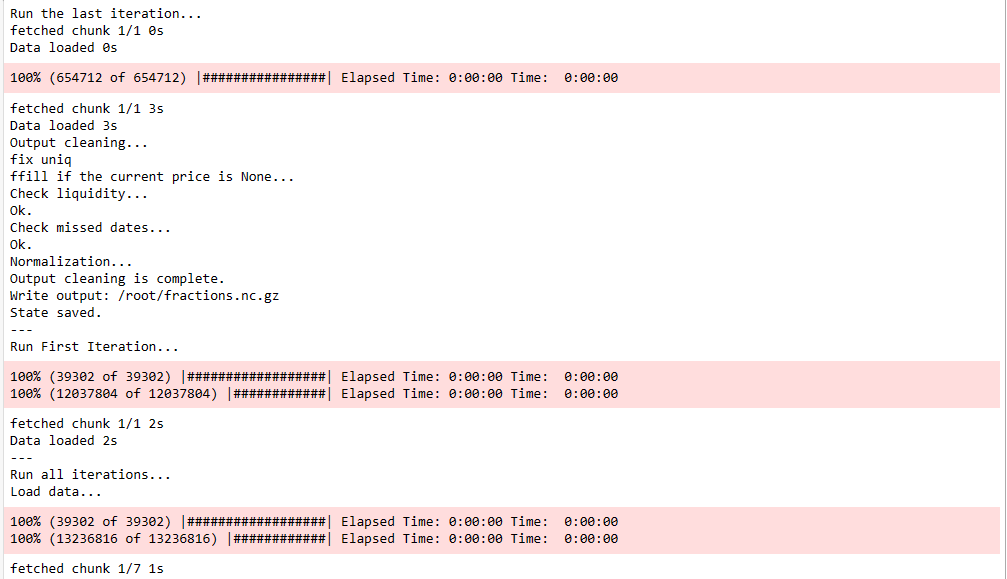

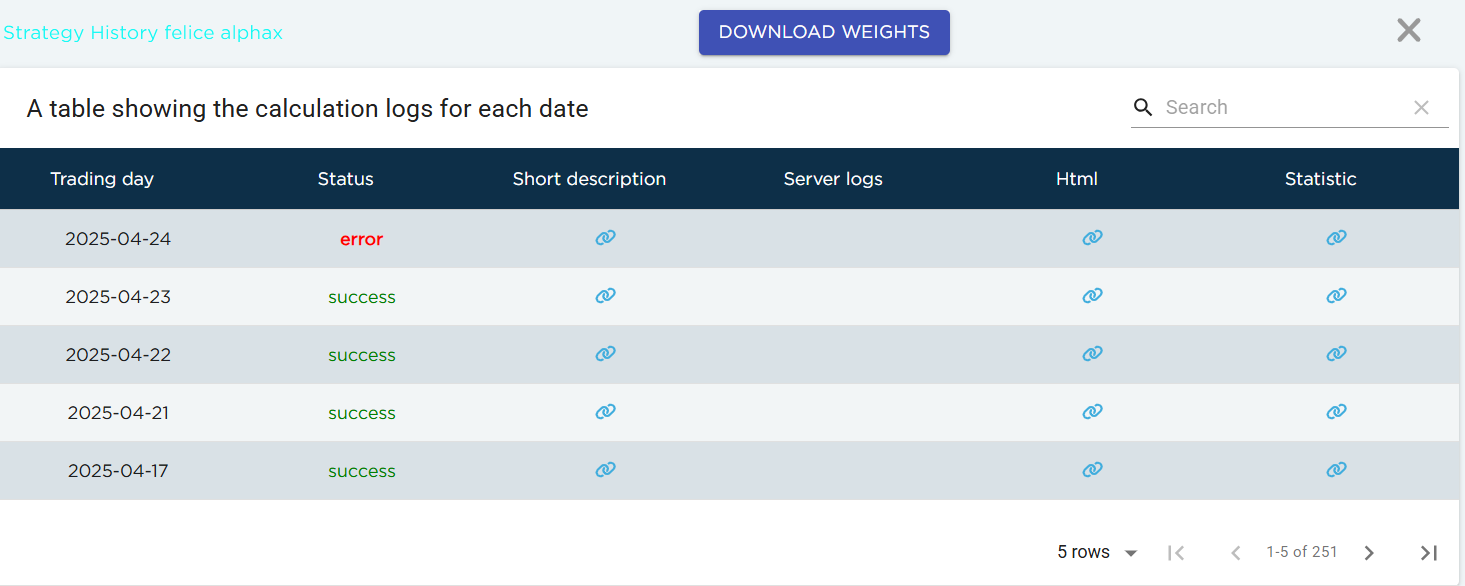

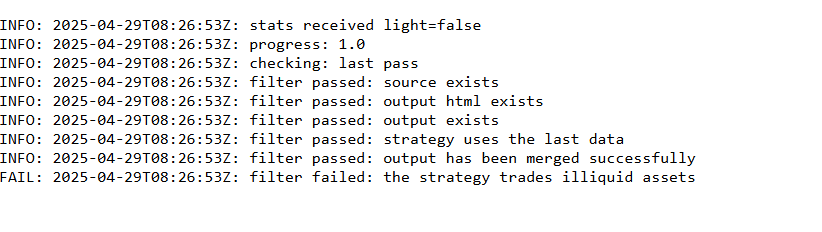

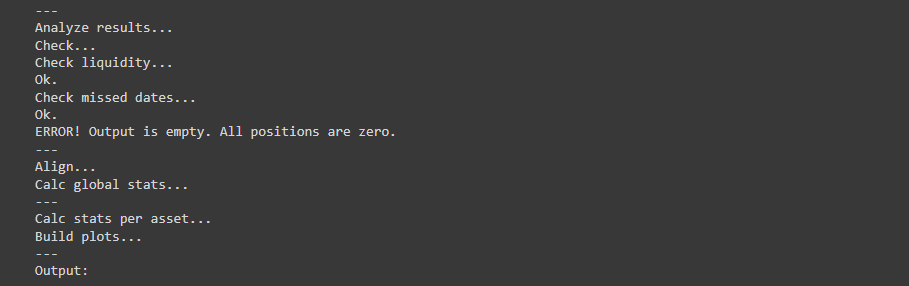

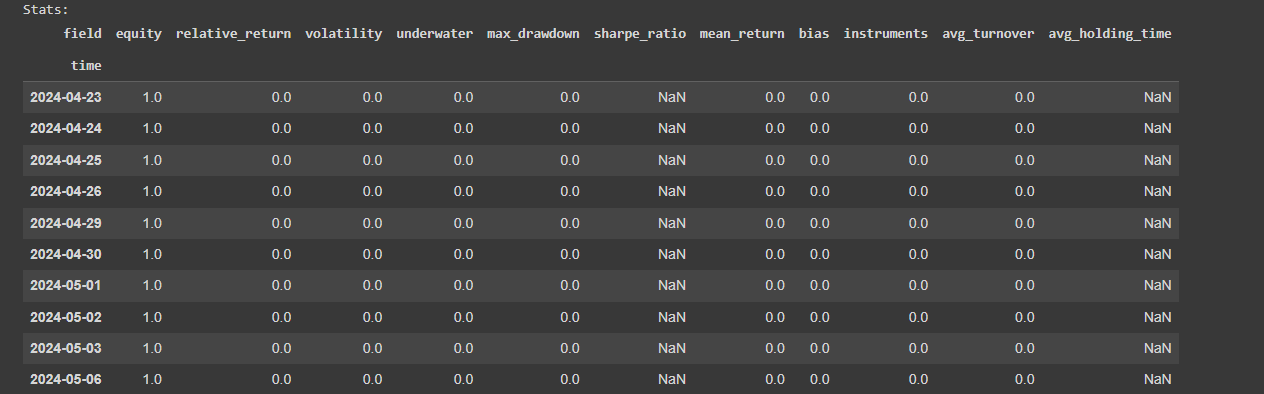

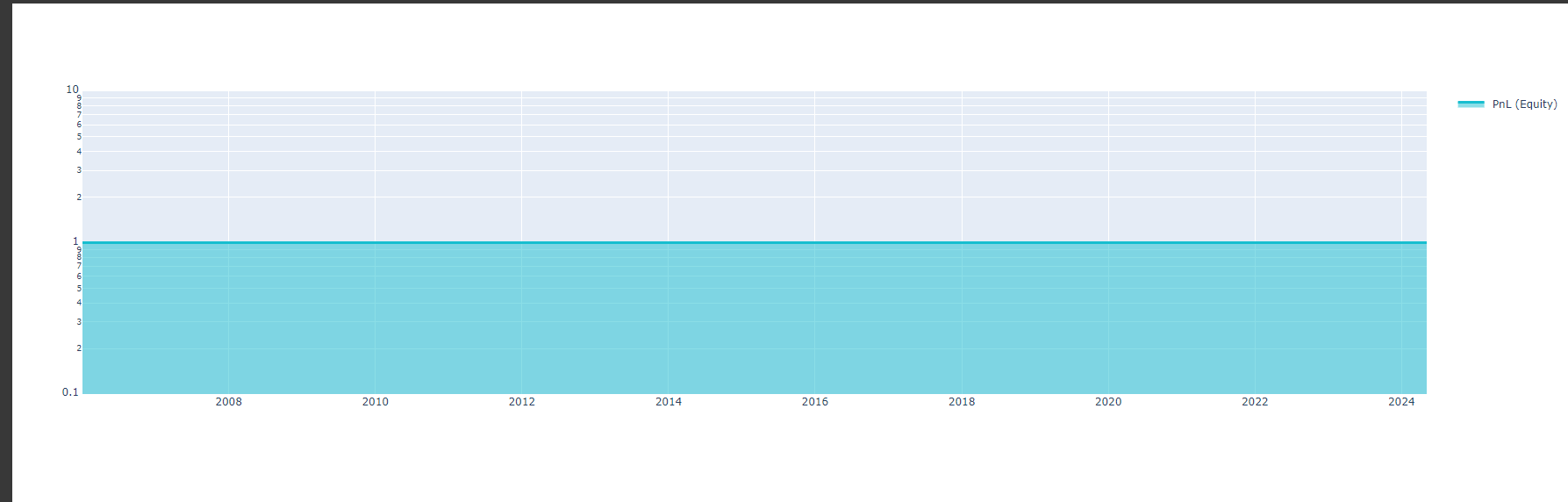

Here is the code I used from your example. I added some other features (eg: trend = qnta.roc(qnta.lwma(data.sel(field='close'), 40), 1),...) and noticed that after passing ml_backtest, every indexes are all nan. Pnl is a straight line. I have tried changing many other features but the result is still the same, all indicators are nan

import xarray as xr

import qnt.data as qndata

import qnt.backtester as qnbt

import qnt.ta as qnta

import qnt.stats as qns

import qnt.graph as qngraph

import qnt.output as qnout

import numpy as np

import pandas as pd

import torch

from torch import nn, optim

import random

asset_name_all = ['NAS:AAPL', 'NAS:GOOGL']

lookback_period = 155

train_period = 100

class LSTM(nn.Module):

"""

Class to define our LSTM network.

"""

def __init__(self, input_dim=3, hidden_layers=64):

super(LSTM, self).__init__()

self.hidden_layers = hidden_layers

self.lstm1 = nn.LSTMCell(input_dim, self.hidden_layers)

self.lstm2 = nn.LSTMCell(self.hidden_layers, self.hidden_layers)

self.linear = nn.Linear(self.hidden_layers, 1)

def forward(self, y):

outputs = []

n_samples = y.size(0)

h_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

c_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

h_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

c_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

for time_step in range(y.size(1)):

x_t = y[:, time_step, :] # Ensure x_t is [batch, input_dim]

h_t, c_t = self.lstm1(x_t, (h_t, c_t))

h_t2, c_t2 = self.lstm2(h_t, (h_t2, c_t2))

output = self.linear(h_t2)

outputs.append(output.unsqueeze(1))

outputs = torch.cat(outputs, dim=1).squeeze(-1)

return outputs

def get_model():

def set_seed(seed_value=42):

"""Set seed for reproducibility."""

random.seed(seed_value)

np.random.seed(seed_value)

torch.manual_seed(seed_value)

torch.cuda.manual_seed(seed_value)

torch.cuda.manual_seed_all(seed_value) # if you are using multi-GPU.

torch.backends.cudnn.deterministic = True

torch.backends.cudnn.benchmark = False

set_seed(42)

model = LSTM(input_dim=3)

return model

def get_features(data):

close_price = data.sel(field="close").ffill('time').bfill('time').fillna(1)

open_price = data.sel(field="open").ffill('time').bfill('time').fillna(1)

high_price = data.sel(field="high").ffill('time').bfill('time').fillna(1)

log_close = np.log(close_price)

log_open = np.log(open_price)

trend = qnta.roc(qnta.lwma(close_price ), 40), 1)

features = xr.concat([log_close, log_open, high_price, trend], "feature")

return features

def get_target_classes(data):

price_current = data.sel(field='open')

price_future = qnta.shift(price_current, -1)

class_positive = 1 # prices goes up

class_negative = 0 # price goes down

target_price_up = xr.where(price_future > price_current, class_positive, class_negative)

return target_price_up

def load_data(period):

return qndata.stocks.load_ndx_data(tail=period, assets=asset_name_all)

def train_model(data):

features_all = get_features(data)

target_all = get_target_classes(data)

models = dict()

for asset_name in asset_name_all:

model = get_model()

target_cur = target_all.sel(asset=asset_name).dropna('time', 'any')

features_cur = features_all.sel(asset=asset_name).dropna('time', 'any')

target_for_learn_df, feature_for_learn_df = xr.align(target_cur, features_cur, join='inner')

criterion = nn.MSELoss()

optimiser = optim.LBFGS(model.parameters(), lr=0.08)

epochs = 1

for i in range(epochs):

def closure():

optimiser.zero_grad()

feature_data = feature_for_learn_df.transpose('time', 'feature').values

in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0)

out = model(in_)

target = torch.zeros(1, len(target_for_learn_df.values))

target[0, :] = torch.tensor(np.array(target_for_learn_df.values))

loss = criterion(out, target)

loss.backward()

return loss

optimiser.step(closure)

models[asset_name] = model

return models

def predict(models, data, state):

last_time = data.time.values[-1]

data_last = data.sel(time=slice(last_time, None))

weights = xr.zeros_like(data_last.sel(field='close'))

for asset_name in asset_name_all:

features_all = get_features(data_last)

features_cur = features_all.sel(asset=asset_name).dropna('time', 'any')

if len(features_cur.time) < 1:

continue

feature_data = features_cur.transpose('time', 'feature').values

in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0)

out = models[asset_name](in_)

prediction = out.detach()[0]

weights.loc[dict(asset=asset_name, time=features_cur.time.values)] = prediction

weights = weights * data_last.sel(field="is_liquid")

# state may be null, so define a default value

if state is None:

default = xr.zeros_like(data_last.sel(field='close')).isel(time=-1)

state = {

"previus_weights": default,

}

previus_weights = state['previus_weights']

# align the arrays to prevent problems in case the asset list changes

previus_weights, weights = xr.align(previus_weights, weights, join='right')

weights_avg = (previus_weights + weights) / 2

next_state = {

"previus_weights": weights_avg.isel(time=-1),

}

# print(last_time)

# print("previus_weights")

# print(previus_weights)

# print(weights)

# print("weights_avg")

# print(weights_avg.isel(time=-1))

return weights_avg, next_state

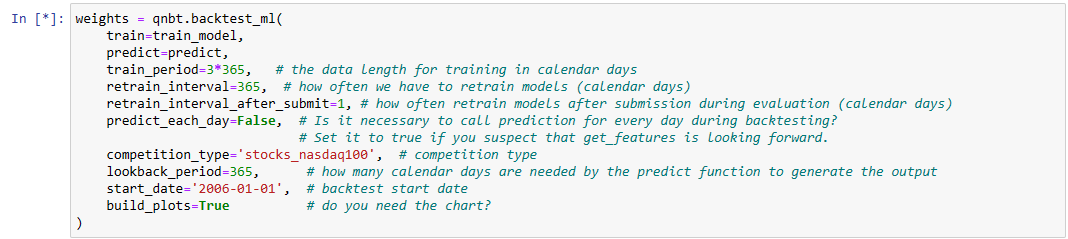

weights = qnbt.backtest_ml(

load_data=load_data,

train=train_model,

predict=predict,

train_period=train_period,

retrain_interval=360,

retrain_interval_after_submit=1,

predict_each_day=True,

competition_type='stocks_nasdaq100',

lookback_period=lookback_period,

start_date='2006-01-01',

build_plots=True

)