Hi

I have been trying to write a simple example with both single pass and multi pass just to understand them better. But I can't get them to produce the same result. Here is what I use:

single pass version:

import xarray as xr

import qnt.ta as qnta

import qnt.data as qndata

data = qndata.futures_load_data(min_date='2006-01-01', max_date='2007-01-01', assets= ['F_ES'])

close = data.sel(field='close')

close_one_day_ago = qnta.shift(close, periods=1)

_open = data.sel(field='open')

open_one_day_ago = qnta.shift(_open, periods=1)

weights = xr.where(open_one_day_ago < close_one_day_ago, 1, 0)

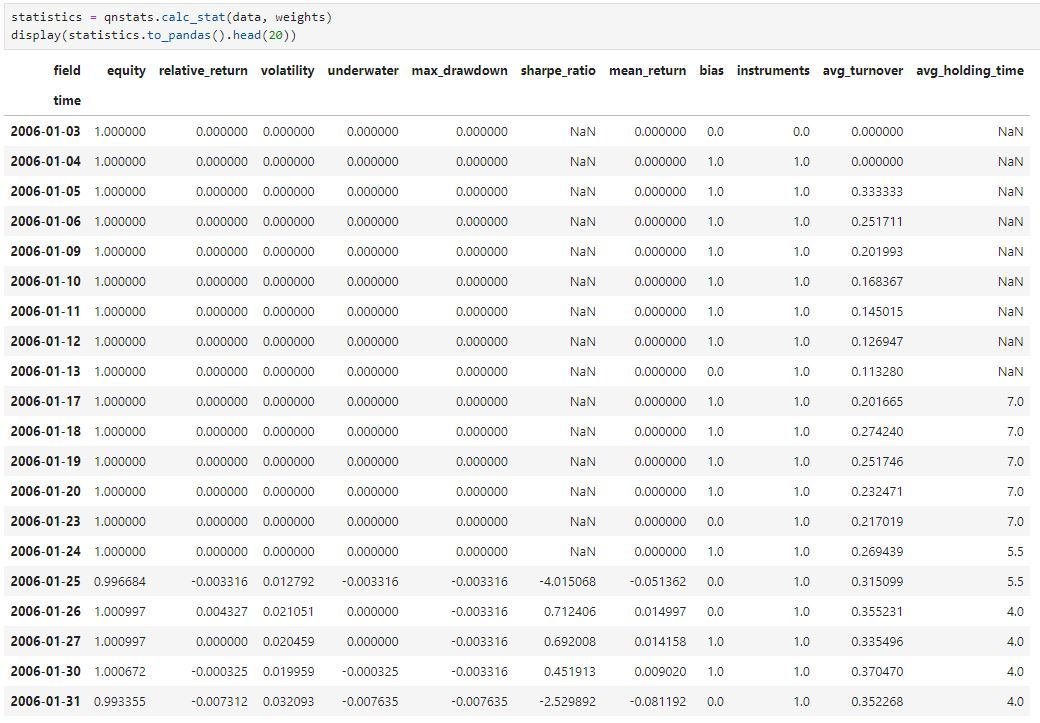

The result looks like the following.

multi pass version:

import xarray as xr

import qnt.ta as qnta

import qnt.backtester as qnbt

import qnt.data as qndata

def load_data(period):

return qndata.futures_load_data(tail=period, assets=['F_ES'])

def strategy(data):

close = data.sel(field='close')

close_one_day_ago = qnta.shift(close, periods=1)

_open = data.sel(field='open')

open_one_day_ago = qnta.shift(_open, periods=1)

weights = xr.where(open_one_day_ago < close_one_day_ago, 1, 0)

return weights

weights = qnbt.backtest(

competition_type= 'futures',

load_data= load_data,

lookback_period= 365,

start_date= '2006-01-01',

end_date= '2007-01-01',

strategy= strategy

)

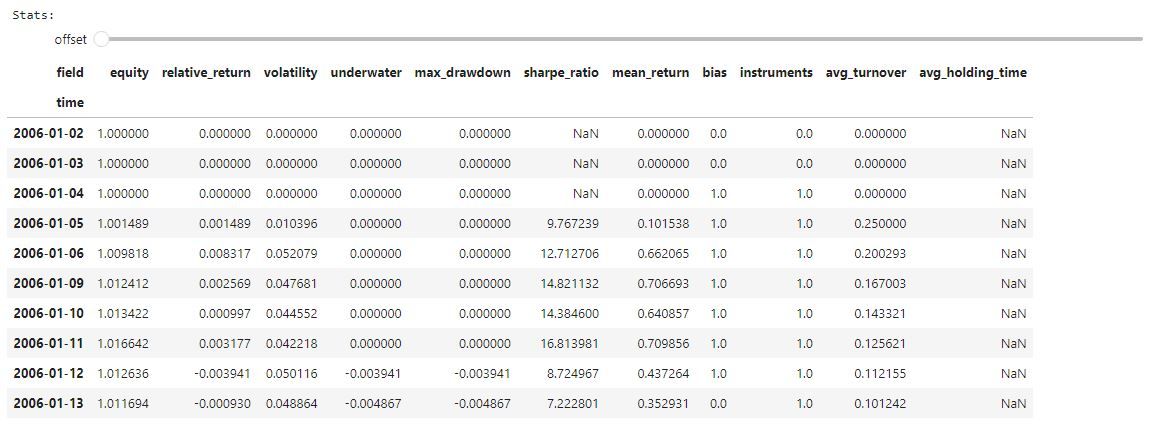

The result look like the following.

Any help/hint/suggestion is greatly appreciated.