Announcement of updates to the Q21 contest

-

Hi @support,

First, congratulations for all great news on the Q21 contest, in particular, for the new set of tools available for improving risk management. These new functions are more than welcome!

Regarding today’s announcement of updates to the Q21 contest, in particular, in respect to the “Exposure” section, from now on it is “mandatory” or it is “advisable” to limit the max investment of 10% of capital per asset?

The announcement says that: “Weight allocations exceeding 0.1 will be adjusted automatically to this limit during live processing.”

This rule above refers only to the function: “qnstats.check_exposure”, that one might use or not in the system, or this rule enforces all systems submitted to the Q21 contest (those submitted until today, and those that will be submitted from now on)?

Many thanks!

-

@sun-73 Hi,

Respecting this exposure rule is mandatory for Q21 contest and will affect all strategies submitted to Q21. Since there are a lot of strategies already submitted to the contest, and possibly many of them are not compliant with the rule, we cannot say it is mandatory in the way that strategy will be rejected if any weight exceeds limit of 10% of capital in in_sample period, but we will apply the rule on evaluation period (contest/live period).

There are various ways how to manage risk/exposure, we presented a few in the Docs, which could be useful to handle the weights to not exceed the exposure limit, like normalize_by_max_exposure(w) and cut_big_positions(w, 0.1), but you can use any other method for normalization you find appropriate.

After submitting a strategy, weights, even after normalization, could exceed the exposure limit (not intentionally or intentionally), and to ensure that the rule has been followed, cut_big_positions(w, 0.1) function will be applied(during live processing for sure). The function qnt.stats.check_exposure is not included in multipass/singlepass output generation at the moment, but can be used as helper function for checking the output.

If you have any further questions (or suggestions) about this new topic, please feel free to ask.

Best regards,

-

@support Hi, is the Q21 Global Leaderboard currently considering the limit of 10% of capital per asset?

Since this rule is binding for all systems submitted to the Q21 contest, it would be interesting to also see the current sharpe ratios when the rule is in place (to better simulate the live phase and help us adapt and optimize the systems to this new rule).

Maybe just adding an extra column (such as "Out-of-Sample Sharpe, lim. 10%") would be enough.

Thanks once again!

-

@sun-73 Hi, thanks for the input, we will check the leaderboard and work on improving the presentation. As mentioned, we will apply the 10% roof once contest (live) starts.

-

Hi,

I would like to know how the classification is done in context. you only look at the shape ratio over the out-of-sample period? -

This post is deleted! -

@dark-pidgeot Hi, yes; the submission has to pass all the filters; then we score it according to the Sharpe ratio in the OOS phase.

-

Hi @support, two quick questions:

(1) Does the limit of 10% for the weight of each asset apply for both (buy and/or sell) positions?

In other words, a vector of weights (0.10, 0.02, -0.10, -0.05...) is OK, but the vector (0.50, 0.20, 0.01, -0.30, -0.05...) will be modified to (0.10, 0.10, 0.01, -0.10, -0.05...)?

(2) This "10% rule" will already be in place during the Live Contest Evaluation Period (July 1, 2024 - October 31, 2024), right?

I asked this question because the current "Out-of-sample Sharpe" column displayed in the "Q21 Global Leaderboard" seems to not include the "10% rule", since some leading systems show high Sharpe ratios using only a few assets, and apparently investing all available capital in them (instead of limiting the individual positions to 10% of capital).

Many thanks again!

-

@sun-73 Hi, yes this exposure limit per asset is applied to short positions, too. The vector of weights will be modified on the same way as you described.

The rule (abs(weight_per_asset) <= 0.1) is already in place from May,17, 2024, and OutOfSample from that date respects the rule for all Q21 submissions. Since we decided to introduce the rule in the middle of Q21, we didn't want to reprocess already submitted strategies to the contest, but just to notify users that the rule will take place for all submissions for sure in the Contest Period, considering only the score from Contest Evaluation Period (July 1, 2024 - October 31, 2024) is relevant for the ranking. -

@support Thank you once again!

-

Hi @support, the system “Sun73_Q21_8e” submitted to Q21 was recently rejected, possibly due to its in-sample Sharpe ratio (0.89). However, in the Q21 competition updates, you informed us that the required Sharpe ratio for contest participation has been adjusted to 0.70.

Could you please check? If the in-sample Sharpe was not the reason for rejection, could you please inform what was the reason?

Other question: I noticed that both Q20 and Q21 Leaderbords have been modified in recent days. For instance, many systems of mine that trade in a buy/sell approach are now only considering the buy weights. Could you please clarify?

Thank you!

-

@sun-73 Dear Sun-73,

Your submission is correlated more than 90% with two submissions from past competitions so it is not eligible for the next one. For the other question, your strategies should have generated correct weights, if strategy is not generating short signals that could be due to the strategy itself. If you notice some exact differences between what strategy should generate and the weights it actually generated, please let us know.

Regards

-

Hi @support,

(1) Regarding rejection of system “Sun73_Q21_8e”, indeed the message in the website says that: “The strategy has a high correlation with standard templates or your strategy from the past competition: #9645444 - 0.91 (IS )”.

Could you please inform which system is #9645444? I could not identify it in my systems submitted to past competitions.

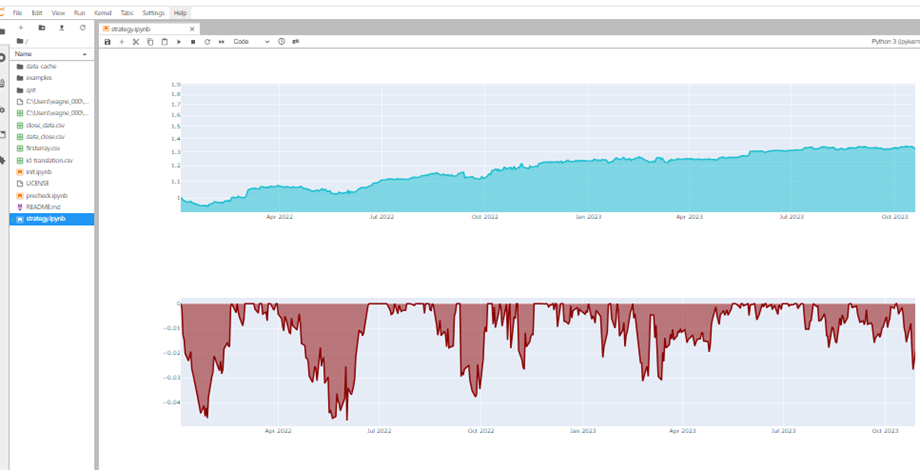

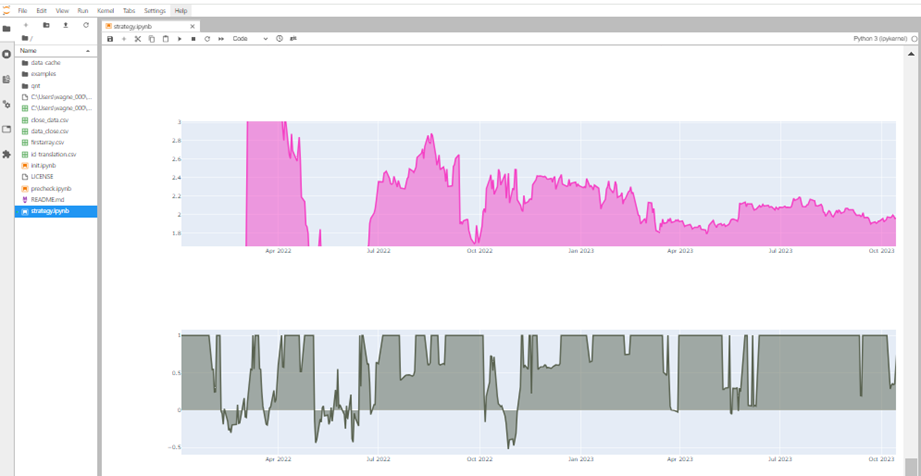

(2) In respect to the missing “sell weights” it seems that current Q21 Leaderboards is somehow “killing” the negative weights. For instance, system “Sun73_Q21_8e” in Quantiacs website shows only positive weights, whereas when I run this system in JupyterLab I got both positive and negative weights (as designed).

Please see the comparison below (since 2022) between the outputs from the website and JupyterLab.

Could you please check what is going on? I believe this issue is happening to other users as well.

Thank you once again!

-

@sun-73 Dear Sun-73,

Regarding the first question, the submission that is mentioned as the correlated to your submission doesn't have to be actually yours (and in this case, it isn't). There is a typo on our platform so thank you for bringing it up.

Regarding the second question, you could see different weights for your strategy which could include different number of short signals (negative weights) if your strategy has forward looking. We eliminate option for forward looking after submitting, so please recheck your strategy about potentially using data from the future to generate signals in the past. We thank you for bringing this issue up as it helps us improve our platform for the future.

As a remainder and as we already emphasized on multiple occasions, hand picking of assets is prohibited and those strategies will not be eligible for the prize, so keep that in mind when developing new systems.

Regards and best of luck in the next competition

-

@support Thank you very much once again!