Machine Learning Strategy

-

@support

ok, the system let me submit a new strategy:

I hope this one works.

I can keep working on getting a higher Sharpe Ratio, and update the strategy, right?

Thanks. -

Yes, you can continue. The system saves a copy when you submit the strategy.

-

@support

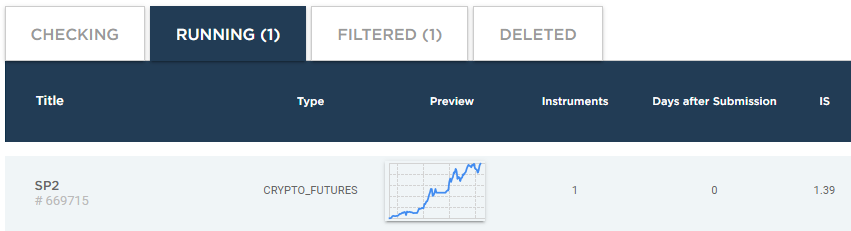

Yaay! I got one accepted

I know the SR is at the bottom of the barrel on the Leaderboard, but I'm still grateful I got one accepted.

Ok, I'm inspired that this is doable for me.

Btw, thanks to everyone on your team for responding to my support requests & helping me understand the Quantiacs platform in a few short weeks.

-

- Can you help pls with an example on how to include more than one feature, such as from the fields (OHLCV)?

- And also from the qnt.ta library?

I am running into a problem converting the feature set to pandas when there are more than one features.

price = data.sel(field="close").ffill('time').bfill('time').fillna(0) # fill NaN for_result = price.to_pandas()Thank you.

-

@spancham Hello, could you elaborate more on your request? In principle, you could just repeat the procedure you use for the "close" and you will work with more dataframes.

-

Hi @support

Ok, let me think about what you are suggesting & see if I can get that to work.

Will let you know.

Thanks. -

@support

ok guys, I tried what you suggested and I am running into all sorts of problems.

I want to pass several features altogether in one dataframe.

Are you guys thinking that I want to 'test' one feature at a time and that is why you are suggesting working with more than one dataframe?

Here is an example of some code I tried, but I would still have to merge the dataframes in order to pass the feature set to the classifier:def get_features(data): # let's come up with features for machine learning # take the logarithm of closing prices def remove_trend(prices_pandas_): prices_pandas = prices_pandas_.copy(True) assets = prices_pandas.columns print(assets) for asset in assets: print(prices_pandas[asset]) prices_pandas[asset] = np.log(prices_pandas[asset]) return prices_pandas # Feature 1 price = data.sel(field="close").ffill('time').bfill('time').fillna(0) # fill NaN price_df = price.to_dataframe() # Feature 2 vol = data.sel(field="vol").ffill('time').bfill('time').fillna(0) # fill NaN vol_df = vol.to_dataframe() # Merge dataframes for_result = pd.merge(price_df, vol_df, on='time') for_result = for_result.drop(['field_x', 'field_y'], axis=1) features_no_trend_df = remove_trend(for_result) return features_no_trend_dfCan you help with some code as to what you are suggesting?

Thanks -

@spancham Hello. Try this

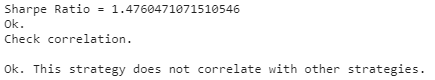

import xarray as xr import qnt.backtester as qnbt import qnt.data as qndata import numpy as np import pandas as pd import logging def load_data(period): return qndata.cryptofutures.load_data(tail=period) def predict_weights(market_data): def get_ml_model(): # you can use any machine learning model from sklearn.linear_model import RidgeClassifier model = RidgeClassifier(random_state=18) return model def get_features_dict(data): def get_features_for(asset_name): data_for_instrument = data.copy(True).sel(asset=[asset_name]) # Feature 1 price = data_for_instrument.sel(field="close").ffill('time').bfill('time').fillna(0) # fill NaN price_df = price.to_dataframe() # Feature 2 vol = data_for_instrument.sel(field="vol").ffill('time').bfill('time').fillna(0) # fill NaN vol_df = vol.to_dataframe() # Merge dataframes for_result = pd.merge(price_df, vol_df, on='time') for_result = for_result.drop(['field_x', 'field_y'], axis=1) return for_result features_all_assets = {} asset_all = data.asset.to_pandas().to_list() for asset in asset_all: features_all_assets[asset] = get_features_for(asset) return features_all_assets def get_target_classes(data): # for classifiers, you need to set classes # if 1 then the price will rise tomorrow price_current = data.sel(field="close").dropna('time') # rm NaN price_future = price_current.shift(time=-1).dropna('time') class_positive = 1 class_negative = 0 target_is_price_up = xr.where(price_future > price_current, class_positive, class_negative) return target_is_price_up.to_pandas() data = market_data.copy(True) asset_name_all = data.coords['asset'].values features_all_df = get_features_dict(data) target_all_df = get_target_classes(data) predict_weights_next_day_df = data.sel(field="close").isel(time=-1).to_pandas() for asset_name in asset_name_all: target_for_learn_df = target_all_df[asset_name] feature_for_learn_df = features_all_df[asset_name][:-1] # last value reserved for prediction # align features and targets target_for_learn_df, feature_for_learn_df = target_for_learn_df.align(feature_for_learn_df, axis=0, join='inner') model = get_ml_model() try: model.fit(feature_for_learn_df.values, target_for_learn_df) feature_for_predict_df = features_all_df[asset_name][-1:] predict = model.predict(feature_for_predict_df.values) predict_weights_next_day_df[asset_name] = predict except: logging.exception("model failed") # if there is exception, return zero values return xr.zeros_like(data.isel(field=0, time=0)) return predict_weights_next_day_df.to_xarray() weights = qnbt.backtest( competition_type="cryptofutures", load_data=load_data, lookback_period=18, start_date='2014-01-01', strategy=predict_weights, analyze=True, build_plots=True )Here is an example with indicators (Sharpe Ratio = 0.8)

def get_features_for(asset_name): data_for_instrument = data.copy(True).sel(asset=[asset_name]) # Feature 1 price = data_for_instrument.sel(field="close") price = qnt.ta.roc(price, 1) price = price.ffill('time').bfill('time').fillna(0) price_df = price.to_pandas() # Feature 2 vol = data_for_instrument.sel(field="vol") vol = vol.ffill('time').bfill('time').fillna(0) # fill NaN vol_df = vol.to_pandas() # Merge dataframes for_result = pd.merge(price_df, vol_df, on='time') return for_result -

@vyacheslav_b

Thank you!

-

This post is deleted!