@illustrious-felice

Incorporating seed initialization into your PyTorch code ensures reproducibility by making the random number generation predictable. This involves setting seeds for the PyTorch engine, NumPy, and the Python random module if you're using it. Below, I'll show you how to integrate seed initialization into your existing code. Remember, while this can make your experiments more reproducible, it does not guarantee identical results across different hardware or PyTorch versions due to the inherent nondeterminism in some GPU operations.

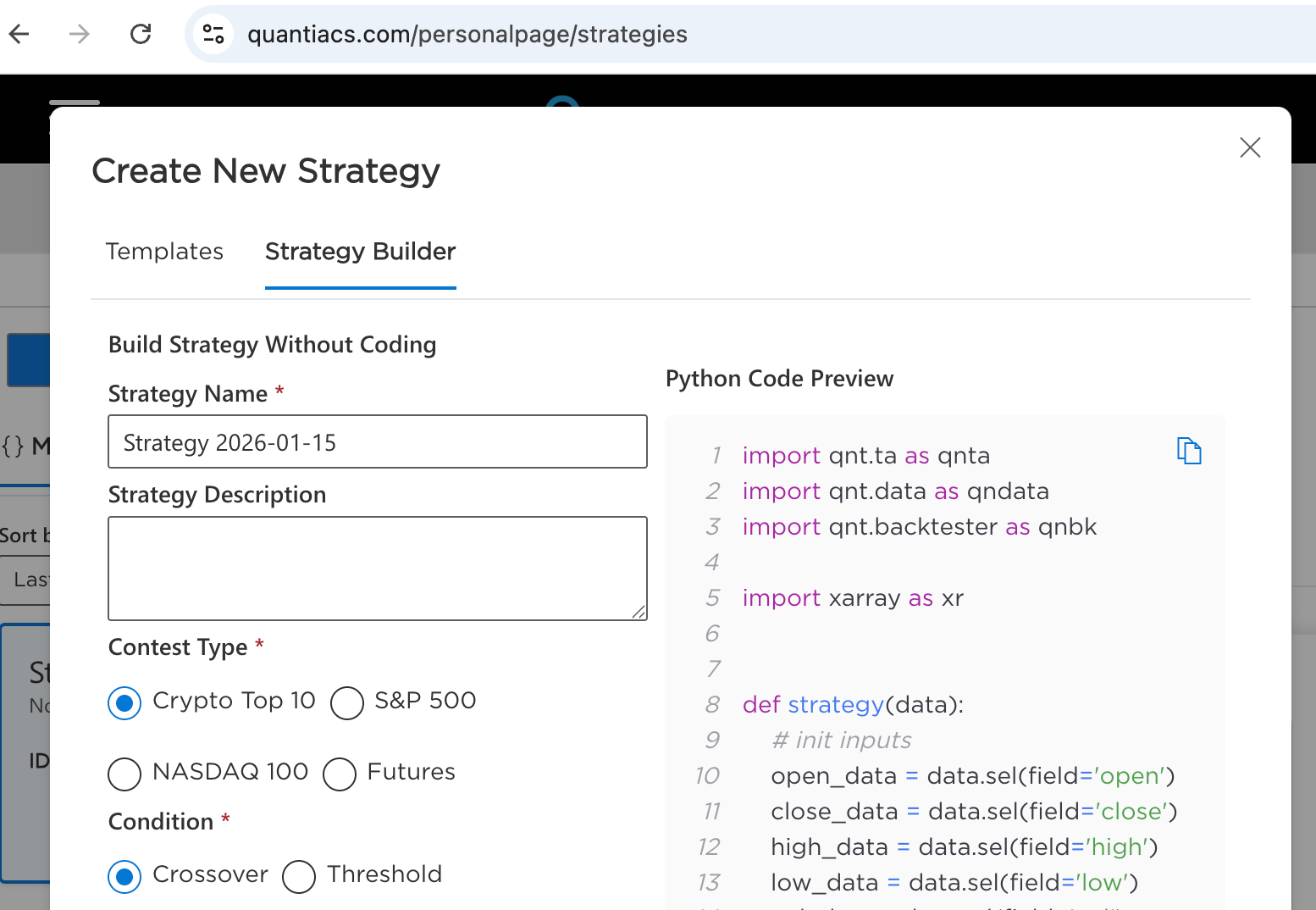

import xarray as xr # xarray for data manipulation

import qnt.data as qndata # functions for loading data

import qnt.backtester as qnbt # built-in backtester

import qnt.ta as qnta # technical analysis library

import numpy as np

import pandas as pd

import torch

from torch import nn, optim

import random

# Seed initialization function

def set_seed(seed_value=42):

"""Set seed for reproducibility."""

random.seed(seed_value)

np.random.seed(seed_value)

torch.manual_seed(seed_value)

torch.cuda.manual_seed(seed_value)

torch.cuda.manual_seed_all(seed_value) # if you are using multi-GPU.

torch.backends.cudnn.deterministic = True

torch.backends.cudnn.benchmark = False

# Set the seed for reproducibility

set_seed(42)

asset_name_all = ['NAS:AAPL', 'NAS:AMZN', 'NAS:MSFT']

class LSTM(nn.Module):

"""

Class to define our LSTM network.

"""

def __init__(self, input_dim=3, hidden_layers=64):

super(LSTM, self).__init__()

self.hidden_layers = hidden_layers

self.lstm1 = nn.LSTMCell(input_dim, self.hidden_layers)

self.lstm2 = nn.LSTMCell(self.hidden_layers, self.hidden_layers)

self.linear = nn.Linear(self.hidden_layers, 1)

def forward(self, y, future_preds=0):

outputs = []

n_samples = y.size(0)

h_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

c_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

h_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

c_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32)

for time_step in range(y.size(1)):

x_t = y[:, time_step, :] # Ensure x_t is [batch, input_dim]

h_t, c_t = self.lstm1(x_t, (h_t, c_t))

h_t2, c_t2 = self.lstm2(h_t, (h_t2, c_t2))

output = self.linear(h_t2)

outputs.append(output.unsqueeze(1))

outputs = torch.cat(outputs, dim=1).squeeze(-1)

return outputs

def get_model():

model = LSTM(input_dim=3)

return model

def get_features(data):

close_price = data.sel(field="close").ffill('time').bfill('time').fillna(1)

open_price = data.sel(field="open").ffill('time').bfill('time').fillna(1)

high_price = data.sel(field="high").ffill('time').bfill('time').fillna(1)

log_close = np.log(close_price)

log_open = np.log(open_price)

features = xr.concat([log_close, log_open, high_price], "feature")

return features

def get_target_classes(data):

price_current = data.sel(field='close')

price_future = qnta.shift(price_current, -1)

class_positive = 1 # prices goes up

class_negative = 0 # price goes down

target_price_up = xr.where(price_future > price_current, class_positive, class_negative)

return target_price_up

def load_data(period):

return qndata.stocks.load_ndx_data(tail=period, assets=asset_name_all)

def train_model(data):

features_all = get_features(data)

target_all = get_target_classes(data)

models = dict()

for asset_name in asset_name_all:

model = get_model()

target_cur = target_all.sel(asset=asset_name).dropna('time', 'any')

features_cur = features_all.sel(asset=asset_name).dropna('time', 'any')

target_for_learn_df, feature_for_learn_df = xr.align(target_cur, features_cur, join='inner')

criterion = nn.MSELoss()

optimiser = optim.LBFGS(model.parameters(), lr=0.08)

epochs = 1

for i in range(epochs):

def closure():

optimiser.zero_grad()

feature_data = feature_for_learn_df.transpose('time', 'feature').values

in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0)

out = model(in_)

target = torch.zeros(1, len(target_for_learn_df.values))

target[0, :] = torch.tensor(np.array(target_for_learn_df.values))

loss = criterion(out, target)

loss.backward()

return loss

optimiser.step(closure)

models[asset_name] = model

return models

def predict(models, data):

weights = xr.zeros_like(data.sel(field='close'))

for asset_name in asset_name_all:

features_all = get_features(data)

features_cur = features_all.sel(asset=asset_name).dropna('time', 'any')

if len(features_cur.time) < 1:

continue

feature_data = features_cur.transpose('time', 'feature').values

in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0)

out = models[asset_name](in_)

prediction = out.detach()[0]

weights.loc[dict(asset=asset_name, time=features_cur.time.values)] = prediction

return weights

weights = qnbt.backtest_ml(

load_data=load_data,

train=train_model,

predict=predict,

train_period=55,

retrain_interval=55,

retrain_interval_after_submit=1,

predict_each_day=False,

competition_type='stocks_nasdaq100',

lookback_period=55,

start_date='2024-01-01',

build_plots=True

)

I think I won't be available next week. If you have any more questions, don’t expect an answer from me next week.

️

️