ERROR! The max exposure is too high

-

@support

After I tested my strategy,

I got the warnings below:

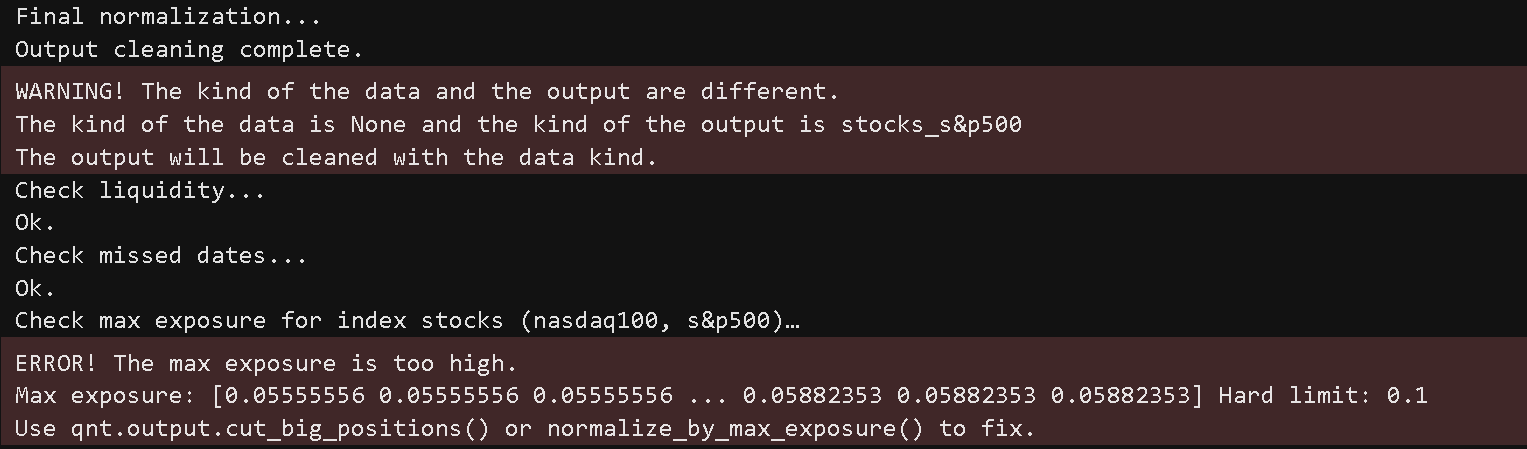

It stated that:- WARNING! The kind of the data and the output are different.

The kind of the data is None and the kind of the output is stocks_s&p500

The output will be cleaned with the data kind. - ERROR! The max exposure is too high.

Max exposure: [0.05555556 0.05555556 0.05555556 ... 0.05882353 0.05882353 0.05882353] Hard limit: 0.1

Use qnt.output.cut_big_positions() or normalize_by_max_exposure() to fix.

Do I need to fix the exposure? Exposure of 0.0588 is below the hard limit 0.1, so it seems that I don't need to decrease the current weights. Am I correct?

BTW, can I just ignore the warning " WARNING! The kind of the data and the output are different." ?

I don't know what should I fix according to this warning. - WARNING! The kind of the data and the output are different.

-

This post is deleted! -

@omohyoid Hello.

1. Check which dataset you're loading

You might have loaded

stocks_nasdaq100, but are checking it as if it werestocks_s&p500.Incorrect:

import qnt.data as qndata import qnt.ta as qnta import qnt.stats as qnstats import qnt.output as qnout import xarray as xr data = qndata.stocks.load_ndx_data(min_date="2005-06-01") qnout.check(weights, data, kind="stocks_s&p500")Correct:

data = qndata.stocks.load_spx_data(min_date="2005-06-01") qnout.check(weights, data, kind="stocks_s&p500") ️

️ kindmust match the actual dataset being used, otherwise some checks (e.g., liquidity or available dates) will not behave correctly.

2. Handling Exposure

If your exposure does exceed the limit on some days, you can fix it using one of the following methods (see the documentation — Applying Exposure Filters:

import qnt.output as qnout import qnt.exposure as qnexp weights_1 = qnexp.cut_big_positions(weights=weights, max_weight=0.049) weights_2 = qnexp.drop_bad_days(weights=weights, max_weight=0.049) weights_3 = qnexp.normalize_by_max_exposure(weights, max_exposure=0.049) weights_4 = qnout.clean(weights, data, "stocks_s&p500")

3. Use

clean()instead ofcheck()for auto-correctionIf you want the system to automatically fix issues like exposure or normalization, replace

check()withclean():import qnt.output as qnout weights = qnout.clean(weights, data, "stocks_s&p500")Exposure of 0.0588 is below the hard limit of 0.1, so in this particular case, it does not violate any constraints. The error may have been triggered by other days or higher values elsewhere in the data — it's worth double-checking.

-

This script provides valuable insights into portfolio optimization, especially for managing exposure limits. Thank you for sharing! To address the max exposure error, consider adjusting the optimization parameters, reducing position sizes, or exploring alternative asset allocation strategies. qnt.output.cut_big_positions() is a good suggestion, and perhaps also tweaking risk tolerance settings.

-

@vyacheslav_b Thanks for ur help!

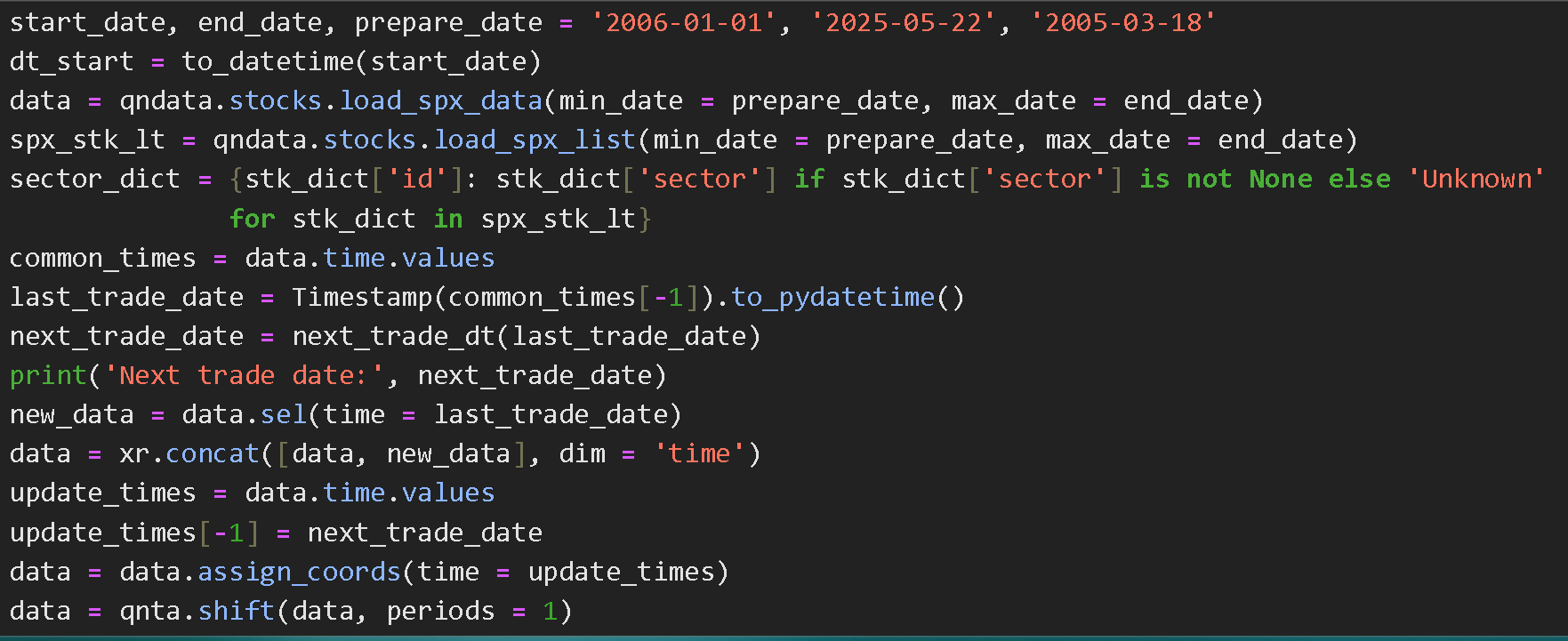

- I checked my code, and I found that I loaded the data by using load_spx_data() instead of load_ndx_data()

But I added the next trading date to the original data in order to write the latest weight. Does this operation cause the warning? - I checked the dataframe of the final weights, and I use the MAX() and the MIN() in excel to check the maximum and the minimum value of the weights, the maximum weight is 0.05, and the minimum weight is -0.05, which is different from the value 0.05882353 showing on the screen.

- I checked my code, and I found that I loaded the data by using load_spx_data() instead of load_ndx_data()

-

@support,

Either something about the exposure calculation is wrong or I really need clarification on the rules. About the position limit I only find rule 7. o. in the contest rules which states "The evaluation system limits the maximum position size for a single financial instrument to 10%"I always assumed this would mean the maximum weight for an asset would be 0.1 meaning 10 % of the portfolio. However the exposure calculation suggests the following:

Either we trade no asset or at least 10 assets per trading day, regardless of the actual weights assigned to each asset.Consider this example:

import qnt.data as qndata import qnt.output as qnout from qnt.filter import filter_sharpe_ratio data = qndata.stocks.load_spx_data(min_date="2005-01-01") weights = data.sel(field='is_liquid').fillna(0) weights *= filter_sharpe_ratio(data, weights, 3) * .01 # assign 1 % to each asset using the top 3 assets by sharpe qnout.check(weights, data, "stocks_s&p500")which results in an exposure error:

Check max exposure for index stocks (nasdaq100, s&p500)… ERROR! The max exposure is too high. Max exposure: [0. 0. 0. ... 0.33333333 0.33333333 0.33333333] Hard limit: 0.1 Use qnt.output.cut_big_positions() or normalize_by_max_exposure() to fix.even though the maximum weight per asset is only 0.01

abs(weights).values.max() 0.01(By the way, the 4 functions mentioned by @Vyacheslav_B also result in weights which dont't pass the exposure check when used with this example, except

drop_bad_dayswhich results in empty weights.)And if we assign 100 % to every liquid asset, the exposure check passes:

weights = data.sel(field='is_liquid').fillna(0) qnout.check(weights, data, "stocks_s&p500")Check max exposure for index stocks (nasdaq100, s&p500)… Ok.So, does rule 7. o. mean we have to trade at least 10 assets or none at all each trading day to satisfy the exposure check?

-

This post is deleted! -

@antinomy Hi,

You are absolutely correct, we will fix check() function ASAP. It should only cut weights which exceed 0.1 allocation by asset, and normalize the sum of allocation to maximum 1, on every timestamp. If sum was < 1, and weight of an asset < 0.1, the output remains the same.

Thanks a lot for pointing this out with examples. -

@omohyoid Hi.

I don’t quite understand why you’re calculating the next trading date manually. According to the documentation and this official example, it works like this:

Strategy. Weights allocation

Every day, the algorithm determines how much of each asset should be in the portfolio for the next trading day.

These are called the portfolio weights.

A positive weight means you'll be buying that asset, while a negative weight means you'll be selling it.

These decisions are made at the end of each day and put into effect at the beginning of the next trading day.There’s a clear visual example in the notebook showing how this works. So there’s no need to manually add or compute the next date — the platform takes care of that automatically.

As for the max weights — I didn’t quite understand what the issue is. If you look at the source code of a function like

cut_big_positions, you’ll see something like this:weights_1 = xr.where(abs(weights) > 0.05, np.sign(weights) * 0.05, weights)This simply limits all weights that are greater than ±0.05 to exactly ±0.05. So if you’re seeing a value like 0.05882353, it’s likely either before this restriction is applied, or maybe you're looking at a version of the weights before post-processing.

-

@antinomy Hello. If you look at how the function works, it limits exposure based on the invested capital, not the total capital — which is stricter than what's stated in the rules. However, in my opinion, this approach has advantages: strategies end up being more diversified, and you won’t be able to trade with just a few assets.

-

@vyacheslav_b Hi, I agree that diversification is always a good idea for trading. It might be helpful if there was an additional function like

check_diversificationwhith a parameter for the minimum number of assets you want to trade. But this function should only warn you and not fix an undiversified portfolio, because the only way would be to add more assets to trade and asset selection should be done by the strategy itself in my opinion.@support Hi, I just checked out

qnt 0.0.504and the problem I mentioned seems to be fixed now, thanks!

Would you perhaps consider to add a leverage check to thecheckfunction?

Because one might think "qnout.check says everything is OK, so I have a valid portfolio" while actually having vastly overleveraged like in my 2nd example whereweights.sum('asset').values.max()is505.0.

Adding something like this tocheckwould tell us about it:log_info("Check max portfolio leverage...") max_leverage = abs(output).sum(ds.ASSET).values.max() if max_leverage > 1 + 1e-13: # (give some leeway for rounding errors and such) log_err("ERROR! The max portfolio leverage is too high.") log_err(f"Max leverage: {max_leverage} Limit: 1.0") log_err("Use qnt.output.clean() or normalize() to fix.") else: log_info("Ok.") -

@antinomy

Hi! Don’t worry about leverage — it isn’t allowed on the Quantiacs platform: all user-supplied weights are automatically normalized when your strategy is saved. Here’s how that works with two instruments.

Source code of the normalize function https://github.com/quantiacs/toolbox/blob/main/qnt/output.py:def normalize(output, per_asset=False): from qnt.data.common import ds output = output.where(np.isfinite(output)).fillna(0) if ds.TIME in output.dims: output = output.transpose(ds.TIME, ds.ASSET) output = output.loc[ np.sort(output.coords[ds.TIME].values), np.sort(output.coords[ds.ASSET].values) ] if per_asset: output = xr.where(output > 1, 1, output) output = xr.where(output < -1, -1, output) else: s = abs(output).sum(ds.ASSET) if ds.TIME in output.dims: s[s < 1] = 1 else: s = 1 if s < 1 else s output = output / s try: output = output.drop_vars(ds.FIELD) except ValueError: pass return outputExample with two assets

import xarray as xr from qnt.data.common import ds from qnt.output import normalize times = ['2025-06-16'] assets = ['Asset1', 'Asset2'] out1 = xr.DataArray([[1.5, 0.5]], coords={ds.TIME: times, ds.ASSET: assets}, dims=[ds.TIME, ds.ASSET]) print(normalize(out1).values) out2 = xr.DataArray([[0.3, -0.2]], coords={ds.TIME: times, ds.ASSET: assets}, dims=[ds.TIME, ds.ASSET]) print(normalize(out2).values)Console output

[[0.75 0.25]] [[ 0.3 -0.2 ]]Example 1: The absolute exposure is 2 > 1, so every weight is divided by 2, yielding 0.75 and 0.25.

Example 2: The exposure is 0.5 < 1, so the scaling factor is set to 1 and the weights stay 0.3 and –0.2.

In short, even if your strategy outputs more than 100 % exposure,

normalizealways scales it back so the total absolute exposure never exceeds 1—preventing leverage on the Quantiacs platform. -

This post is deleted!