@dark-pidgeot said in Q20 contest results:

@support said in Q20 contest results:

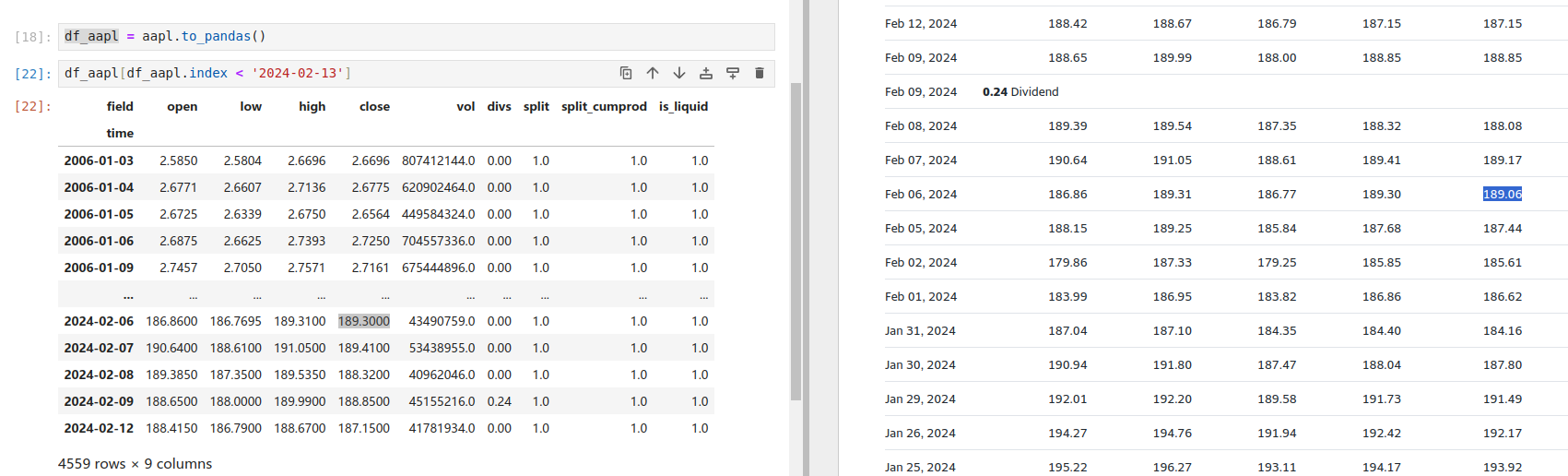

That is also a good observation. In general, we would like a long-only system with low turnover to beat the Nasdaq index for example. But still, we see a lot of problems with hand-picking stocks and survivorship-bias affected systems.

if I understand correctly

if I initially select 10 stocks, and even if I have a good sharpe ratio, my strategy can make long and short positions. I could be disqualified

That's my understanding too. If you initially select 10 stocks, that already implies survivorship-bias, and is in fact "forward looking" because in for instance year 2010 you could not foresee which 10 stocks would still exist in the index in 2024.