@support Thank you for clarification!

Posts made by buyers_are_back

-

RE: Does evaluation only start from one year back?posted in Support

-

RE: Does evaluation only start from one year back?posted in Support

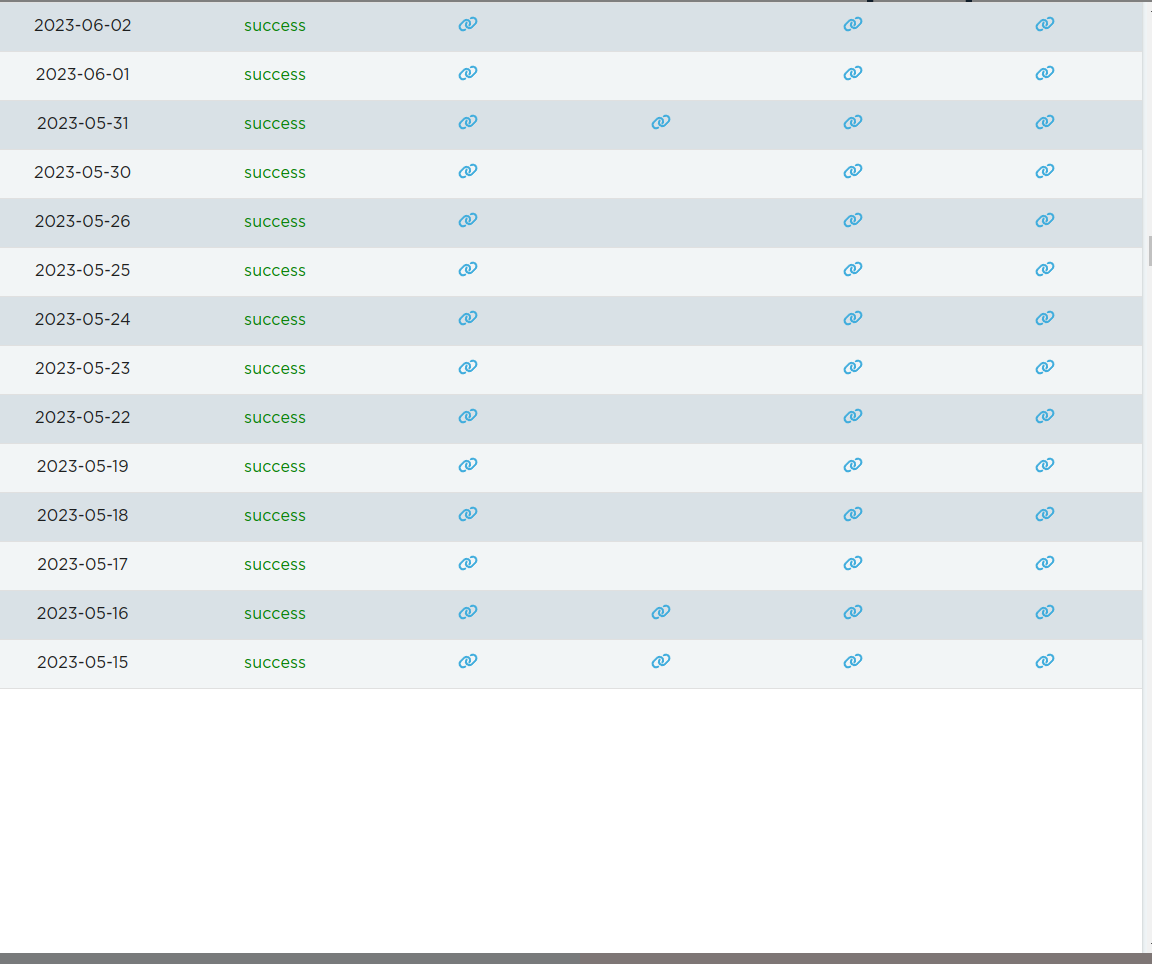

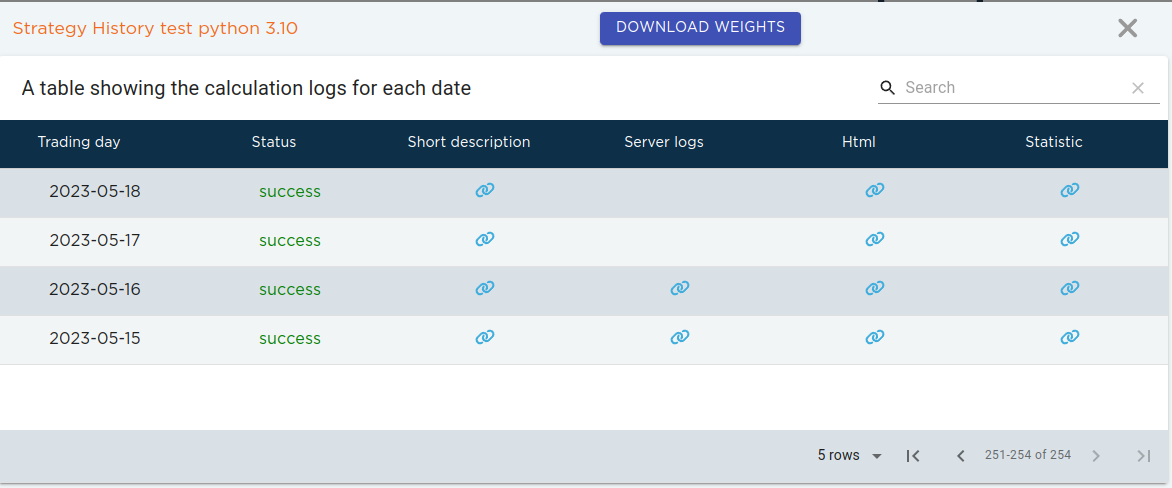

This was the last page. If I set it to show 1000 rows per page I still only see results from 2023-05-15.

Did I miss something?

-

Does evaluation only start from one year back?posted in Support

Hi,

I was playing around with strategies and found that the evaluation only starts from one year back? I remember previously it started from 2016-01-01. This kinda breaks my submission.

I'd love to know if this is intentional. Thanks

-

RE: Accessing both market and index data in strategy()posted in Support

@vyacheslav_b Thank you! I'll have a look

-

Accessing both market and index data in strategy()posted in Support

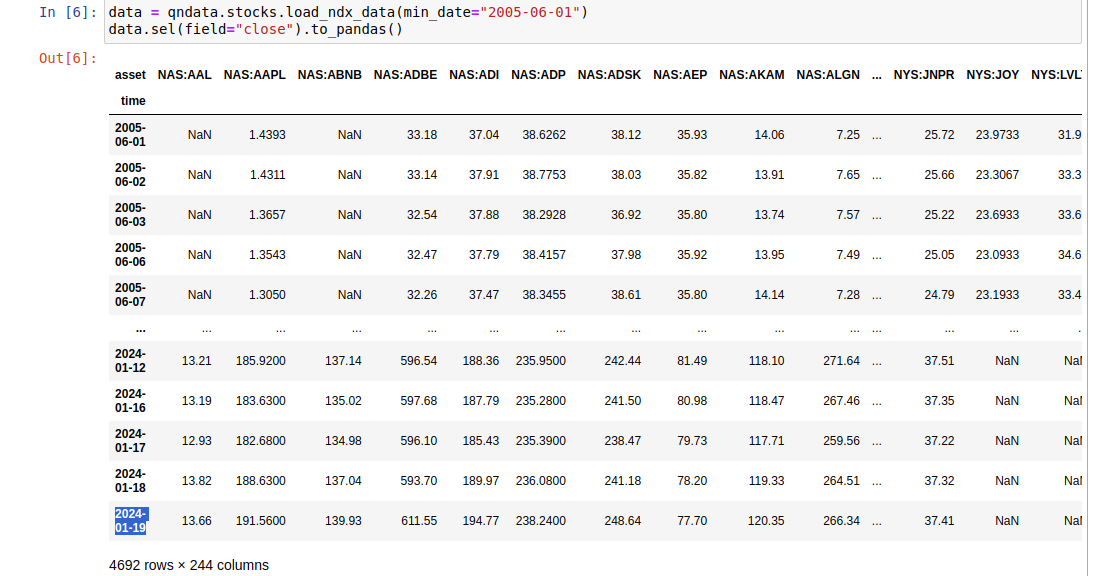

Hi, I'd like to access to access both market and index data in strategy(). Would the following code work? It worked locally but when submitted the "checking" progress does not move at all.

# load data data = qndata.stocks.load_ndx_data(min_date="2005-01-01") def strategy(data): # get index data index_name = 'NDX' index_data = qndata.index.load_data(assets=[index_name], min_date='2005-01-01', forward_order=True) index_data = xr.align(index_data.sel(asset=index_name), data.isel(field=0), join='right')[0] ndx_values = index_data.valuesI also tried a

load_datafunction where I load both datasets and useload_data=load_datainqnbt.backtest(), but it quickly leads to a memory leak. -

RE: Can I reuse strategyposted in Support

Thank you, I noticed some changes on the rules so I have to reimplement the strategy anyway.

-

Can I reuse strategyposted in Support

Hi I have a strategy in q20 but I want to reuse it in q21.

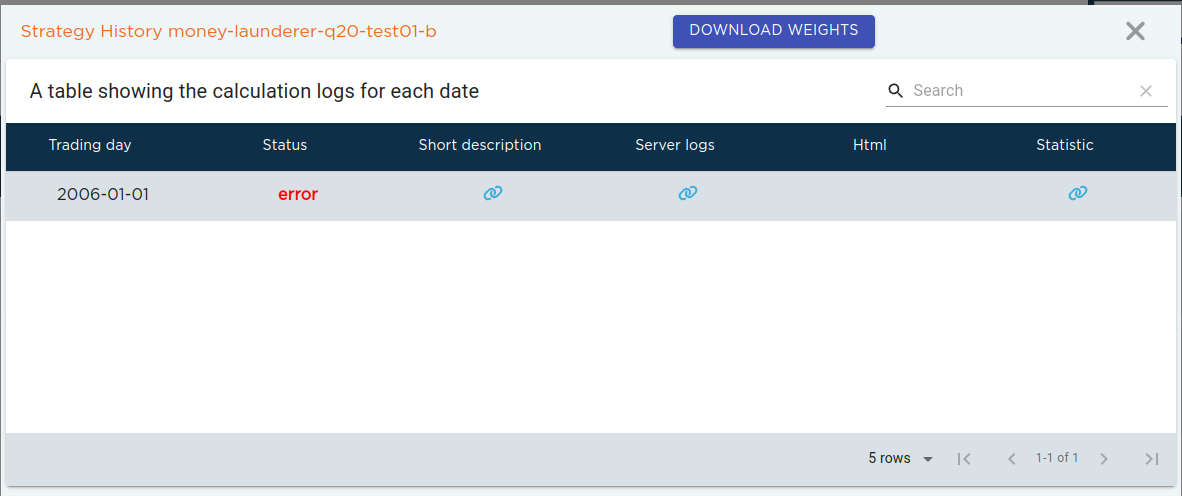

I reuploaded it as # 16543405 but it says

"The strategy has a high correlation with standard templates or your strategy from the past competition:

#15136749 money-launderer-q20-test01-b - 1.00 (IS null)"This is the one I want to reuse. Would it be possible?

Best regards

-

RE: Fundamental data incomplete?posted in Support

Thanks for the reply. I know "market cap = #shares * price". The real issue is that #shares is not available for some stocks (e.g. META) so I have to rely on other data sources like yahoo finance.

Do you have an update? Thanks!

-

RE: Fundamental data incomplete?posted in Support

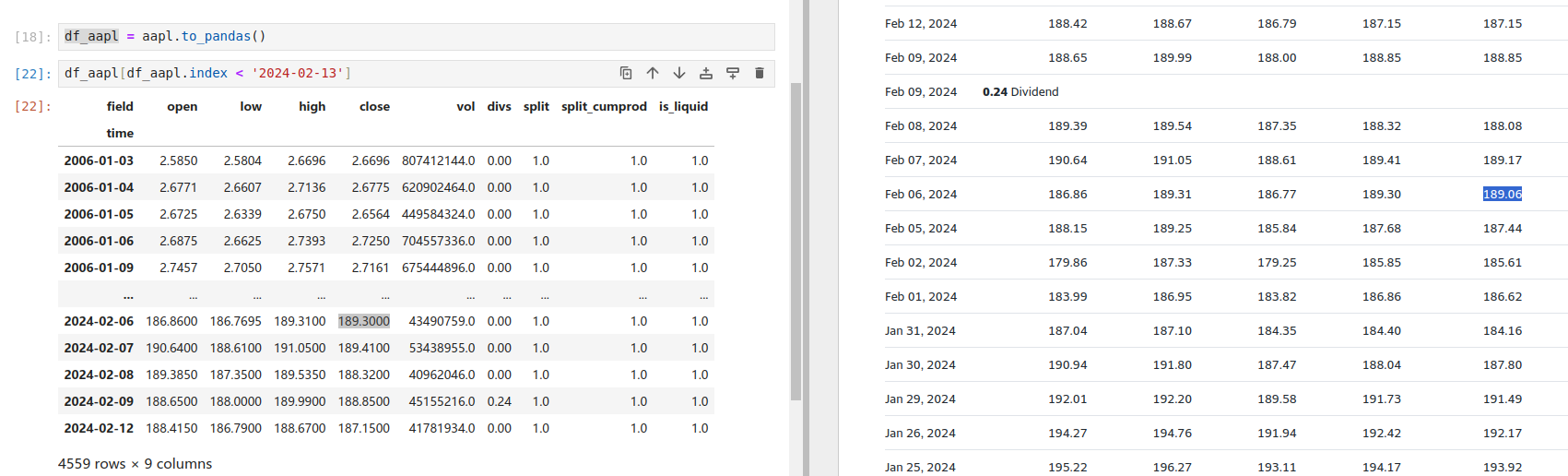

@support I have 3 more questions regarding adjusted close.

(1) I have not checked the source code but I assume your backtest / online evaluation is based on split- and divident-adjusted close prices?

(2) In

qnt.qndata.stocksonly close is provided. I checked it is split-adjusted properly but not dividend-adjusted (see attached screenshot). Should we retroactively compute the adjusted close based ondivs? It would be nice to have it in the data so we don't have to compute it every time.

(3) The

split_cumprodcolumn is always 1. What does it mean? It's probably not important. -

RE: Fundamental data incomplete?posted in Support

@support Thank you, looking forward to your update.

-

RE: Fundamental data incomplete?posted in Support

@support Thank you for the information. Is there a way to get the market cap of each stock in your framework?

Furthermore what is your data source? I see for example Shares Outstanding / Implied Shares Outstanding of "NAS:ABNB" is available on yahoo finance. https://finance.yahoo.com/quote/ABNB/key-statistics

-

Fundamental data incomplete?posted in Support

Hi,

could you please check the fundamental data? I want to access

sharesbut for some stocks they arenanor 0. I just list the result of the last day (liquidity is checked). There are probably more in the data before.Thanks!

import qnt.data.secgov_fundamental as fundamental indicators_data = fundamental.load_indicators_for(market_data, indicator_names=['shares']) for symbol in symbols: if market_data.sel(asset=symbol, field='is_liquid').values[-1] == 1: print(symbol, indicators_data.sel(asset=symbol, field='shares').values[-1])NAS:META nan

NAS:LULU 56574615254.22

NAS:CDW 33285349512.0

NAS:MDB 25767646010.4

NAS:FANG 34372380817.46

NAS:GFS 28094353231.94

NAS:AVGO 573720125618.37

NAS:AMD 293136048694.22

NAS:CSX 72448787967.15999

NAS:LRCX 122063448150.0

NAS:MSFT 3131260131262.89

NAS:QCOM 183135600000.0

NAS:CDNS 84897732150.0

NAS:BIIB 31780231266.739998

NAS:INTU 177660674450.0

NAS:ASML 374502070437.11

NAS:TTWO 24769146877.199997

NAS:MAR 72319227139.16

NAS:NFLX 268631184172.16

NAS:MDLZ 97282992944.75

NAS:EXC 36793013731.020004

NAS:TSLA 545618293897.8

NAS:KDP 40670292503.1

NAS:WBA 17859797164.170002

NAS:CCEP 32580298037.100002

NAS:MRNA 40159714892.88

NAS:DASH nan

NAS:GEHC 41337329248.62

NAS:INTC 177787400000.0

NAS:ADI 94490338901.0

NAS:AMAT 167292873657.04

NAS:CTAS 63627808606.45

NAS:PEP 236126948757.80002

NAS:SBUX 103698198000.0

NAS:MNST 63000117666.9

NAS:VRTX 107249405203.2

NAS:SNPS 89193820979.90001

NAS:ORLY 66984680438.55

NAS:CPRT 54101457174.100006

NAS:DLTR 27929003604.03

NAS:TXN 151632812349.47998

NAS:AMZN 1827140369086.9001

NAS:BKNG 119802937241.46

NAS:DXCM 51724604035.56999

NAS:ON 31639413394.08

NAS:TMUS 190777094005.5

NAS:WBD 20737341514.5

NAS:VRSK 34046494056.96

NAS:CRWD nan

NAS:KHC 42786029487.490005

NAS:TTD nan

NAS:AEP 43841699622.2

NAS:MU 103767434720.0

NAS:PAYX 43552833819.04

NAS:ROST 49298041330.380005

NAS:ADSK 54802967111.75

NAS:ADP 100286301121.70999

NAS:IDXX 44404626994.02

NAS:AZN nan

NAS:ANSS 29792286582.59

NAS:CSGP 38431317106.1

NAS:CTSH 37163907688.8

NAS:CHTR 0.0

NAS:FTNT 51725867964.920006

NAS:PANW 90655398000.0

NAS:WDAY 0.0

NAS:NXPI 60621839878.799995

NAS:GOOGL nan

NAS:PDD nan

NAS:AMGN 145625242968.73

NAS:KLAC 92102230350.06

NAS:AAPL 2719006406480.0

NAS:EA 35546917294.560005

NAS:XEL 29106817021.1

NAS:ADBE 235577880000.00003

NAS:FAST 43609858258.549995

NAS:CSCO 198977053111.2

NAS:REGN 0.0

NAS:ODFL 46154568504.22

NAS:GILD 91452314560.56

NAS:ILMN 21159124000.0

NAS:ABNB nan

NAS:DDOG nan

NAS:PYPL 67530454850.64

NAS:TEAM nan -

RE: Q20 contest resultsposted in News and Feature Releases

@dark-pidgeot said in Q20 contest results:

@support said in Q20 contest results:

That is also a good observation. In general, we would like a long-only system with low turnover to beat the Nasdaq index for example. But still, we see a lot of problems with hand-picking stocks and survivorship-bias affected systems.

if I understand correctly

if I initially select 10 stocks, and even if I have a good sharpe ratio, my strategy can make long and short positions. I could be disqualified

That's my understanding too. If you initially select 10 stocks, that already implies survivorship-bias, and is in fact "forward looking" because in for instance year 2010 you could not foresee which 10 stocks would still exist in the index in 2024.

-

How to get NASDAQ100 index weights?posted in Strategy help

Hi all,

I am wondering is there a way to get the weights of the constitutes of the index from the data? I need not only the current weights but also historical ones for the strategy.

To be honest I am not sure how the index value is calculated. I thought it was just a weighted sum, then I can just do a matrix inverse to get the weights. However Wikipedia gives some more complexed definition:

It is a modified capitalization-weighted index. The stocks' weights in the index are based on their market capitalizations, with certain rules capping the influence of the largest components.

I am not sure how this capping works and would appreciate it if someone has an idea. Thanks.

Best regards

-

Is data up-to-date?posted in Support

Hi all,

I am doing some test for q21 now and found the data from

qndatapackage is not up-to-date (today is Jan 26 but I can only get data till Jan 19). I am using the online environment.Best regards

-

RE: Submission failed: what's wrong??posted in Support

@support I just checked again and saw one of my strategies magically showed up in the "candidates" lol (which was previously in "filtered"). I was totally absent these days and wonder if something has changed? anyway happy that I made the first step.

-

RE: Submission failed: what's wrong??posted in Support

Hi @support , thanks! gonna check the format again when I've got time

-

Submission failed: what's wrong??posted in Support

Hi all,

I'm fairly new just trying to learn. I wanted to submit some test strategy which was all good locally and in the online environment with sr>1 with multipass test. However when I submitted it seemed it was not even executed? Here are the logs (which is obscure tbh)

INFO: 2023-09-11T23:35:42Z: pass started: 15136753

INFO: 2023-09-11T23:35:44Z: nxt: 2006-01-03T00:00:00Z

INFO: 2023-09-11T23:35:44Z: next date: 2006-01-03T00:00:00Z

INFO: 2023-09-11T23:35:47Z: nxt: 2006-01-03T00:00:00Z

INFO: 2023-09-11T23:35:47Z: next date: 2006-01-03T00:00:00Z

INFO: 2023-09-12T00:15:45Z: stats received light=false

INFO: 2023-09-12T00:15:45Z: progress: 0.0

INFO: 2023-09-12T00:15:45Z: checking: first pass

INFO: 2023-09-12T00:15:45Z: filter passed: source exists

INFO: 2023-09-12T00:15:45Z: filter passed: output html exists

FAIL: 2023-09-12T00:15:45Z: filter failed: output missed

INFO: 2023-09-12T00:37:46Z: pass completed: 15136753statistics:

{"id":14162495,"series":[],"submission_id":"15136749","output_exists":false,"source_exists":true,"last_data":true,"non_liquid":null,"trades_only_btc":null,"output_dates_missed":false,"exposure_check_succeed":null,"ref_output":null,"html_gz":null,"correlated_list":[],"ref_date":1136073600000,"last_date":null,"light":false,"state":null}Can you please help me know what was the issue?