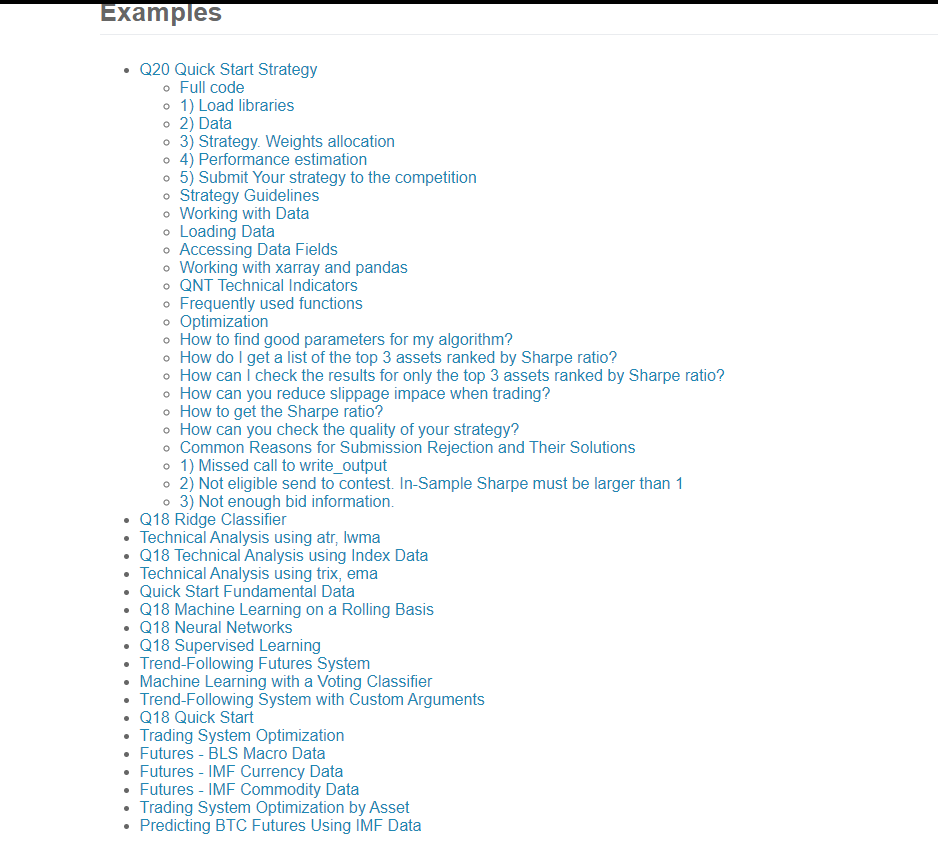

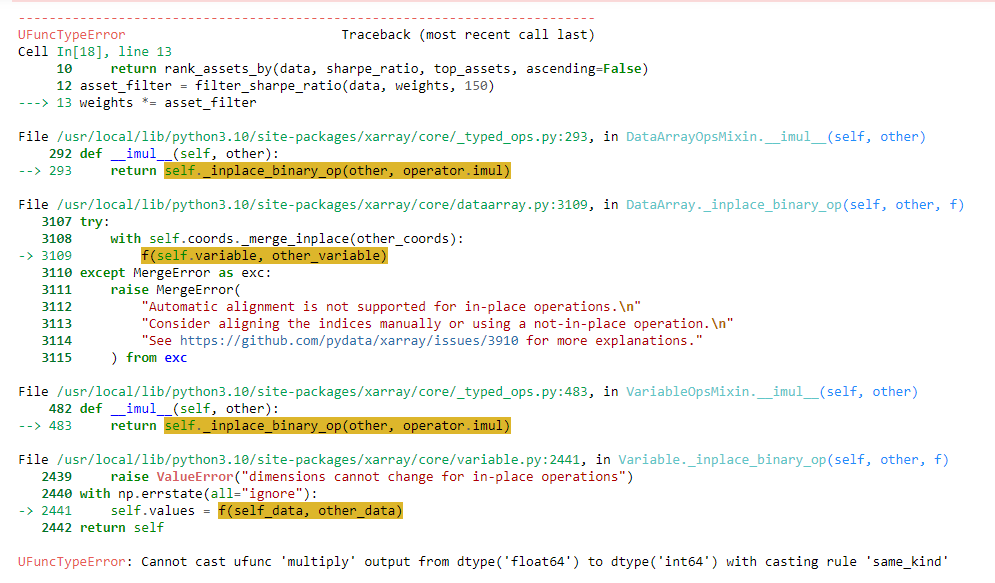

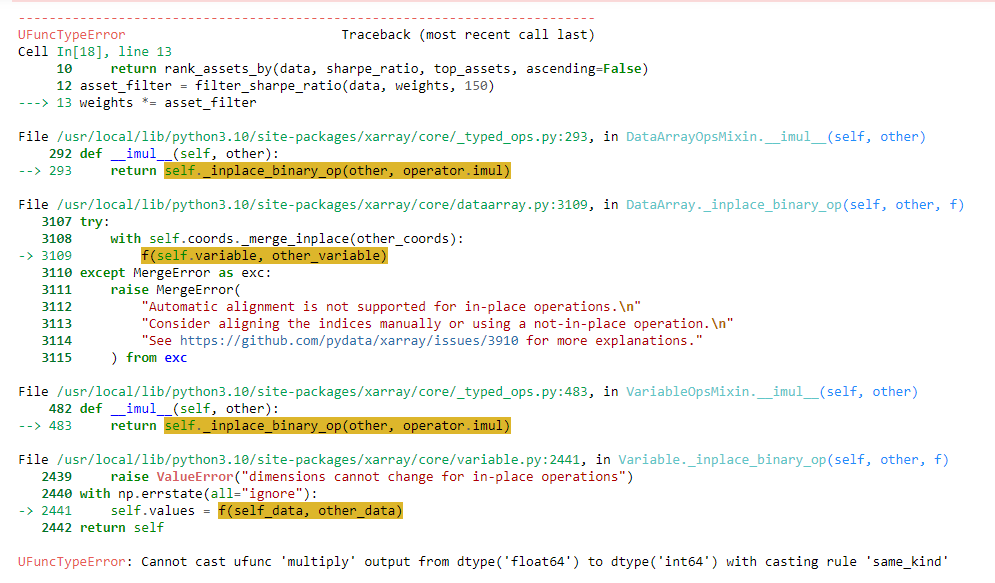

Hi, I'm testing the new ticker filtering methods that Quantiacs provides, but I'm getting the error Cannot cast ufunc 'multiply' output from dtype('float64') to dtype('int64') with casting rule 'same_kind'

This is my code

# Import basic libraries.

import xarray as xr

import pandas as pd

import numpy as np

# Import Quantiacs libraries.

import qnt.data as qndata # load and manipulate data

import qnt.output as qnout # manage output

import qnt.backtester as qnbt # backtester

import qnt.stats as qnstats # statistical functions for analysis

import qnt.graph as qngraph # graphical tools

import qnt.ta as qnta # indicators library

import qnt.xr_talib as xr_talib # indicators library

data = qndata.stocks.load_ndx_data(min_date="2005-06-01")

def filter_volatility(data, rolling_window, top_assets, metric="std", ascending=True):

"""

Filter and rank assets based on volatility over a rolling window.

Args:

data (xarray.Dataset): The dataset containing asset data.

rolling_window (int): Window size for the rolling volatility computation.

top_assets (int): Number of top assets to select.

metric (str): Volatility metric to use ('std' for standard deviation).

ascending (bool): Rank order, True for lowest first.

"""

prices = data.sel(field='close')

daily_returns = prices.diff('time') / prices.shift(time=1)

rolling_volatility = calc_rolling_metric(daily_returns, rolling_window, metric)

volatility_ranks = rank_assets_by(data, rolling_volatility, top_assets, ascending)

return volatility_ranks

def calc_rolling_metric(condition, rolling_window, metric="std"):

"""

Compute a rolling metric (standard deviation or mean) over a specified window for a given condition.

Args:

condition (xarray.DataArray): Data over which the metric is computed.

rolling_window (int): Window size for the rolling computation.

metric (str): Type of metric to compute ('std' for standard deviation, 'mean' for average).

Raises:

ValueError: If an unsupported metric is specified.

"""

if metric == "std":

return condition.rolling({"time": rolling_window}).std()

elif metric == "mean":

return condition.rolling({"time": rolling_window}).mean()

else:

raise ValueError(f"Unsupported metric: {metric}")

def rank_assets_by(data, criterion, top_assets, ascending):

"""

Rank assets based on a specified criterion. Returns a DataArray where top ranked assets are marked with a '1'.

Args:

data (xarray.Dataset): The dataset containing asset data.

criterion (xarray.DataArray): The data based on which assets are ranked.

top_assets (int): Number of top assets to select.

ascending (bool): True for ascending order, False for descending order.

"""

volatility_ranks = xr.DataArray(

np.zeros_like(data.sel(field='close').values),

dims=['time', 'asset'],

coords={'time': data.coords['time'], 'asset': data.coords['asset']}

)

for time in criterion.coords['time'].values:

daily_vol = criterion.sel(time=time)

ranks = (daily_vol if ascending else -daily_vol).rank('asset')

top_assets_indices = ranks.where(ranks <= top_assets, drop=True).asset.values

volatility_ranks.loc[dict(time=time, asset=top_assets_indices)] = 1

return volatility_ranks.fillna(0)

close = data.sel(field="close")

sma_slow = qnta.sma(close, 200)

sma_fast = qnta.sma(close, 20)

weights = xr.where(sma_slow < sma_fast, 1, -1)

def filter_sharpe_ratio(data, weights, top_assets):

stats_per_asset = qnstats.calc_stat(data, weights, per_asset=True)

sharpe_ratio = stats_per_asset.sel(field="sharpe_ratio")

return rank_assets_by(data, sharpe_ratio, top_assets, ascending=False)

asset_filter = filter_sharpe_ratio(data, weights, 150)

weights *= asset_filter

# Liquidity filter and clean

is_liquid = data.sel(field="is_liquid")

weights = weights * is_liquid

weights = qnout.clean(weights, data, "stocks_nasdaq100")

stats = qnstats.calc_stat(data, weights.sel(time=slice("2006-01-01", None)))

display(stats.to_pandas().tail())

performance = stats.to_pandas()["equity"]

qngraph.make_plot_filled(performance.index, performance, name="PnL (Equity)", type="log")

weights = weights.sel(time=slice(date,None))

qnout.check(weights, data, "stocks_nasdaq100")

qnout.write(weights) # to participate in the competition

Besides I couldn't import the qnfilter library so I had to call the function directly from the strategy. Looking forward to your support. Thank you

@Vyacheslav_B @support