@support thx for your reply.

I also saw some discussion related to a similar topic in the general discussion.

I will try to explain what I mean, if it doesnt make sense just ignore it and if I get something wrong, pls let me know.

The point i am making is lets imagine the evaluation period starts on 01.06.2024 and my Deep Learning model meets the criteria for evaluation.

Now since 01.06.2024 is the first day, the model will predict for this day and assign the weights for assets traded on 01.06.2024, one day before, where it is trained.

Now to my understanding, the model is retrained everyday for the single-pass submission of the DL-Model, which therefore will have different weights (model weights, not allocation weights) for the next day training (01.06.2024) and will predict one step ahead, the allocations for 02.06.2024, and so on.

So my question is, that under this framework I do not have access to the previous weights, right ? (For 01.06.2024 model training, I do not know what allocation weights I assigned on 31.05.2024)(I dont know whether with the stateful model I can have access to lets say up to 60 days of previous allocations)

The weights assigned however, are saved somewhere with quantiacs ,as these allocation were made in the past but are not accessible to me ,lets say on 03.06.2024.

SO if I want to reduce slippage, so that I on 03.06.2024 want to change allocations only if the predictions are larger since the beginning of the evaluation, how can I do that.

I hope it makes sense what I am trying to say.

Regards

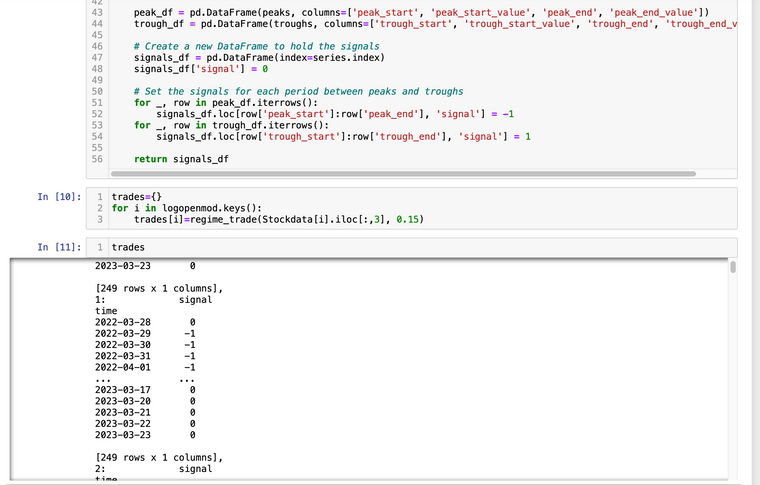

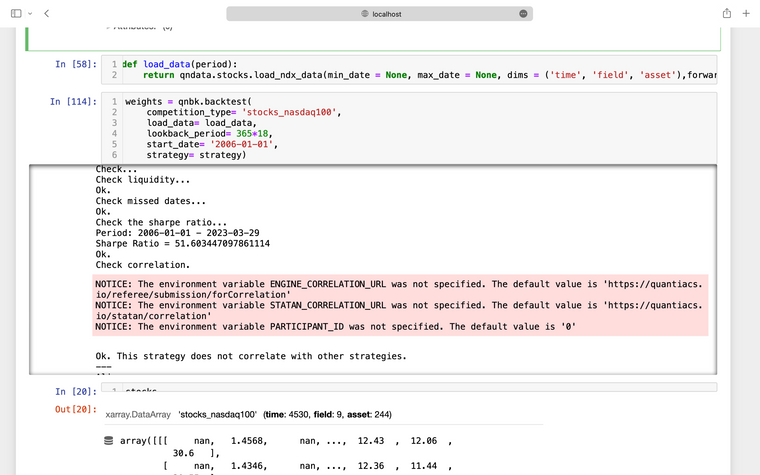

As you can see in the picture I have a good sharpe Ratio but when submitted ,the strategy got rejected because the sharpe ratio is too low. If I assume there is no bug in your multipass backtest, the issue should be the statelessness of your backtester. I tried to correct the code and to my understanding it should be fine but I dont know, and if I only rely on getting the news after submission, I will miss the deadline. Could you therefore pls have a look at the notebook too and if it does not take too much time correct anything if possible. Thank you. Regards

As you can see in the picture I have a good sharpe Ratio but when submitted ,the strategy got rejected because the sharpe ratio is too low. If I assume there is no bug in your multipass backtest, the issue should be the statelessness of your backtester. I tried to correct the code and to my understanding it should be fine but I dont know, and if I only rely on getting the news after submission, I will miss the deadline. Could you therefore pls have a look at the notebook too and if it does not take too much time correct anything if possible. Thank you. Regards