Hello,

I'm testing combining crypto with stocks for Q21 but I'm getting an error. We hope to help.

Thank you.

Below is my code

# Import basic libraries.

import xarray as xr

import pandas as pd

import numpy as np

# Import Quantiacs libraries.

import qnt.data as qndata # load and manipulate data

import qnt.output as qnout # manage output

import qnt.backtester as qnbt # backtester

import qnt.stats as qnstats # statistical functions for analysis

import qnt.graph as qngraph # graphical tools

import qnt.ta as qnta # indicators library

import qnt.xr_talib as xr_talib # indicators library

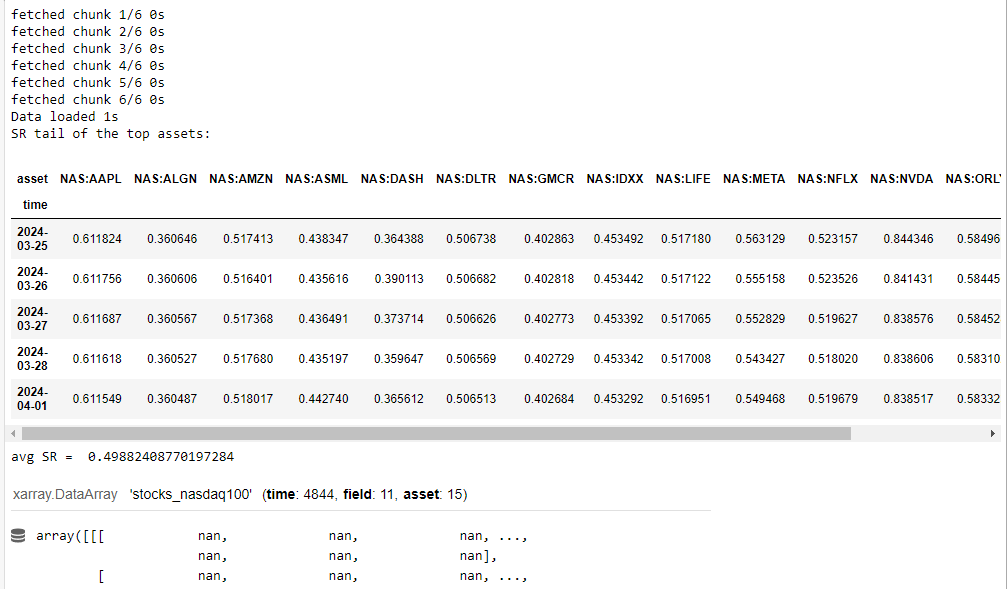

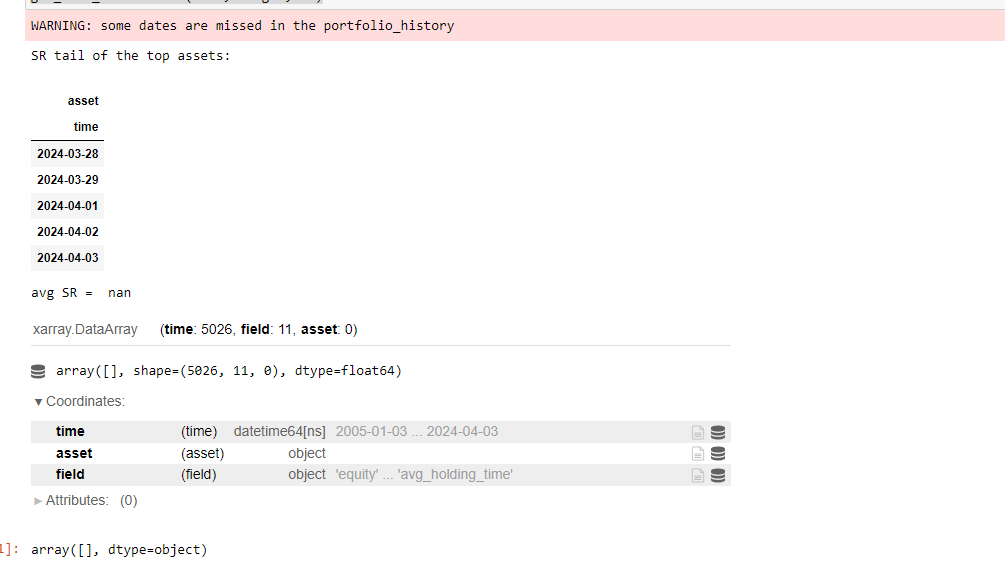

def load_data(period):

futures = qndata.futures.load_data(tail=period).isel(asset=0)

stocks = qndata.stocks.load_ndx_data(tail=period)

crypto= qndata.crypto.load_data(tail=period)

return {"futures": futures, "stocks": stocks, "crypto": crypto}, futures.time.values

def window(data, max_date: np.datetime64, lookback_period: int):

min_date = max_date - np.timedelta64(lookback_period, "D")

return {

"futures": data["futures"].sel(time=slice(min_date, max_date)),

"stocks": data["stocks"].sel(time=slice(min_date, max_date)),

"crypto": data["crypto"].sel(time=slice(min_date, max_date)),

}

def strategy(data):

close_futures = data["crypto"].sel(field="close")

close_stocks = data["stocks"].sel(field="close")

sma20 = qnta.sma(close_futures, 20).isel(time=-1)

sma20_stocks = qnta.sma(close_stocks, 20).isel(time=-1)

is_liquid = data["stocks"].sel(field="is_liquid").isel(time=-1)

weights = xr.where(sma20 < sma20_stocks, 1, -1)

weights = weights * is_liquid

weights = weights / 100.0

return weights

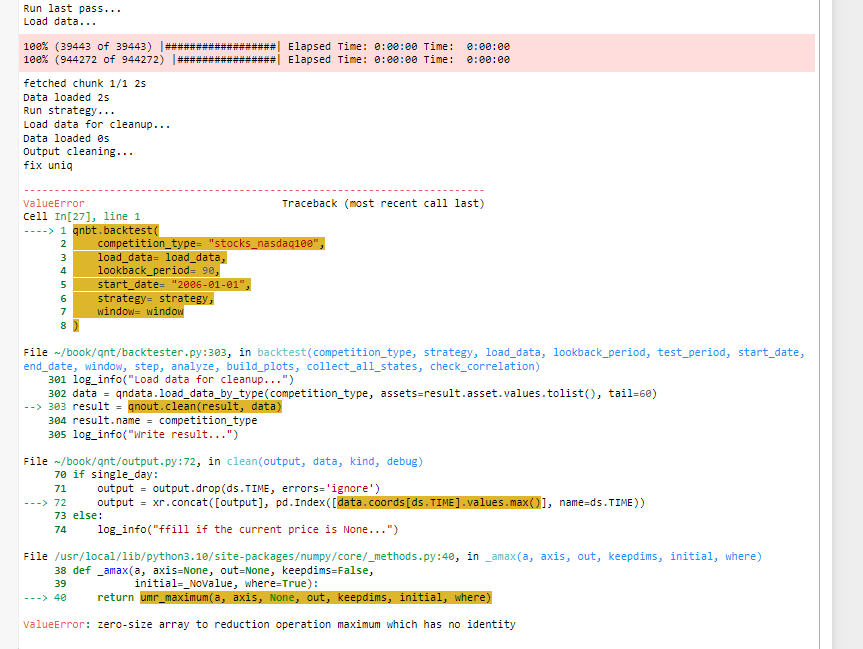

qnbt.backtest(

competition_type= "stocks_nasdaq100",

load_data= load_data,

lookback_period= 90,

start_date= "2006-01-01",

strategy= strategy,

window= window

)