Hi @support, none of my 15 accepted systems are in the Q23 leaderboard as well. Could you please verify? Thanks!

Posts made by Sun-73

-

RE: I cant not find my strategy in Q23 leaderboardposted in Support

-

RE: Strategy takes a long time to get verifiedposted in Support

@support, thank you for the clarifications. Regards.

-

RE: Strategy takes a long time to get verifiedposted in Support

Hi @support,

As the deadline for Q23 approaches, it is expected that new submissions take longer to be processed before being considered to the contest.

However, I’ve noticed that several recent submissions of mine are usually stucked at 0% of “Checking progress”, and then are suddenly rejected (filtered) due to “Calculation time exceeded”.

These are simple strategies, based on technical analysis, that are processed quite fast in JupyterLab. Very similar strategies indeed passed the filters and were accepted for the Q23 contest some weeks ago.

One possible reason is that some users are submitting to the contest much more than 15 strategies (for instance, user “Svyable” has 50 strategies displayed in Q23 Global Leaderboard, instead of the maximum of 15 strategies, as stated in Q23 rules). The system should block an excessive number of submissions in Q23 leaderboard (and limit it to 15 instead to 50).

Other reason might be the “I use machine learning” option when submitting a strategy, that could allow a “fast-track” submission (more computer processing dedicated to such strategies?), compared to the strategies that do not select this option.

Could you please check and clarify these issues?

Thanks!

-

Max exposureposted in Support

Hi @support,

The JupyterLab run of new strategies for Q23 contest is giving the message below regarding max exposure:

Check max exposure for index stocks (nasdaq100, s&p500)…

ERROR! The max exposure is too high.

Max exposure: [0.10520976 0.10536531 0.1051576 ... 0.09200489 0.09211786 0.09212628] Hard limit: 0.1

Use qnt.output.cut_big_positions() or normalize_by_max_exposure() to fix.However, the strategy already cuts the abs(weight) if above 0.10.

Besides, module 'qnt.output' has no attribute 'cut_big_positions'.

Thanks!

-

RE: "Show only my results" not workingposted in Support

Hi @support, thank you! The box is now working fine!

I have a simple suggestion regarding the charts created for each strategy:

Besides the equity curve (strategy, SPX and Nasdaq100), Logarithmic scale, Long/Short, Underwater, and Bias, it would be nice to see an additonal chart (with two lines) showing the number of assets in each day that have a positive weight (long position), as well as the number of assets in each day that have a negative weight (short position).

This will help us developing the strategies, since we can better track the outcomes generated by different algorithms being constructed.

Also, this can help you identify asset hand-picking with buy-and-hold positions.

Thanks!

-

"Show only my results" not workingposted in Support

Hi @support, the box “Show only my results” in the Q23 Global Leaderboard is not working. Thanks!

-

RE: Q22 submission, strategies excludedposted in Support

Hi @support, everything is all right now. Thank you!

-

Q22 submission, strategies excludedposted in Support

Hi @support, last week, a set of previously submitted (and accepted) strategies were moved from the Q22 competition (from the “Candidates” area, in the website, to the “Filtered” area).

Some strategies were submitted more recently while others several months ago.

In the “Filtered” area, there is no comment attached to each strategy to justify the mentioned exclusion from Q22.

The strategies are the following: Sun73_Q22_6a, Sun73_Q22_5a_v3, Sun73_Q22_4a, Sun73_Q22_2e, Sun73_Q22_2d, Sun73_Q22_2c

Could you please check this issue? I noticed that it also happened to other users as well.

Many thanks!

-

RE: Strategy filtered after a few daysposted in Strategy help

Hi @angusslq, the same thing happened to me (ex: with my strategy Sun73_Q22_6a).

Hi @support, can you please check this issue for us? Thank you!

-

RE: Q22 contestposted in News and Feature Releases

Hi @support, regarding the upcoming Q22 contest on S&P500 (long-short), a couple of questions:

-

How can one upload stocks data for S&P500? For NASDAQ-100, we use qndata.stocks_load_ndx_data(tail=period)

-

Is there a maximum limit of stocks to be traded on a given day (or, in principle, one can use all available liquid stocks for that day)?

-

Is there a limit for the weights? In Q21 contest, the limit was a maximum of 10% of capital to be invested in a given stock in a given day.

Thank you!

-

-

RE: Q21 submissionposted in Support

Hi @support,

System Sun73_Q21_6aaa #17158009 is not being updated in the Q21 leaderboard. The "Date End" for this system seems to be stucked at 2024-06-12.

Could you please check it?

Many thanks!

-

Q22 contestposted in News and Feature Releases

Hi @support,

When do you expect to start the Q22 contest?

Any information on the asset class (NASDAQ-100, Futures...) of this new contest? Long-short or long-only?

Thanks!

-

RE: Q21 submissionposted in Support

Hi @support, my strategies still do not appear in the Q21 Leaderboard.

Also, I submitted 6 new systems on 2024-06-29 that are still 0% checking. Could you please verify if everthing is all right?

Thanks a lot!

-

RE: Announcement of updates to the Q21 contestposted in Support

@support Thank you very much once again!

-

RE: Announcement of updates to the Q21 contestposted in Support

Hi @support,

(1) Regarding rejection of system “Sun73_Q21_8e”, indeed the message in the website says that: “The strategy has a high correlation with standard templates or your strategy from the past competition: #9645444 - 0.91 (IS )”.

Could you please inform which system is #9645444? I could not identify it in my systems submitted to past competitions.

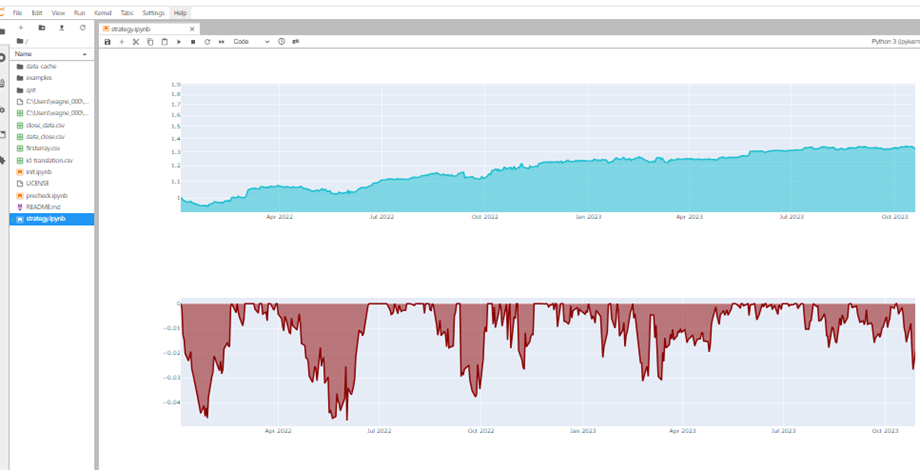

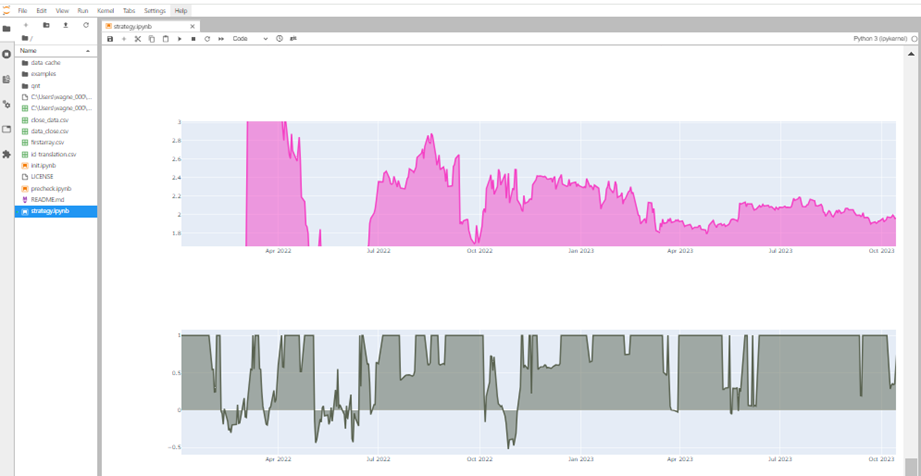

(2) In respect to the missing “sell weights” it seems that current Q21 Leaderboards is somehow “killing” the negative weights. For instance, system “Sun73_Q21_8e” in Quantiacs website shows only positive weights, whereas when I run this system in JupyterLab I got both positive and negative weights (as designed).

Please see the comparison below (since 2022) between the outputs from the website and JupyterLab.

Could you please check what is going on? I believe this issue is happening to other users as well.

Thank you once again!

-

RE: Announcement of updates to the Q21 contestposted in Support

Hi @support, the system “Sun73_Q21_8e” submitted to Q21 was recently rejected, possibly due to its in-sample Sharpe ratio (0.89). However, in the Q21 competition updates, you informed us that the required Sharpe ratio for contest participation has been adjusted to 0.70.

Could you please check? If the in-sample Sharpe was not the reason for rejection, could you please inform what was the reason?

Other question: I noticed that both Q20 and Q21 Leaderbords have been modified in recent days. For instance, many systems of mine that trade in a buy/sell approach are now only considering the buy weights. Could you please clarify?

Thank you!

-

RE: Announcement of updates to the Q21 contestposted in Support

Hi @support, two quick questions:

(1) Does the limit of 10% for the weight of each asset apply for both (buy and/or sell) positions?

In other words, a vector of weights (0.10, 0.02, -0.10, -0.05...) is OK, but the vector (0.50, 0.20, 0.01, -0.30, -0.05...) will be modified to (0.10, 0.10, 0.01, -0.10, -0.05...)?

(2) This "10% rule" will already be in place during the Live Contest Evaluation Period (July 1, 2024 - October 31, 2024), right?

I asked this question because the current "Out-of-sample Sharpe" column displayed in the "Q21 Global Leaderboard" seems to not include the "10% rule", since some leading systems show high Sharpe ratios using only a few assets, and apparently investing all available capital in them (instead of limiting the individual positions to 10% of capital).

Many thanks again!