Acess previous weights

-

@vyacheslav_b said in Acess previous weights:

If you use a state and a function that returns the prediction for one day, you will not get correct results with precheck.

Theoretically, you can specify the number of partitions as all available days. or you can return all predictions

I have not checked how the precheck works.

If it works in parallel, you will not see the correct result even more so.

State in strategy limits you. I recommend not using it.Thank you so much @Vyacheslav_B.

I just tried applying the single pass you suggested but the results were nan. Looking forward to your help when you have time. thank you very much

-

@machesterdragon

That's how it should be. This code is needed so that submissions are processed faster when sent to the contest. The backtest system will calculate the weights for each day. The function I provided calculates weights for only one day. -

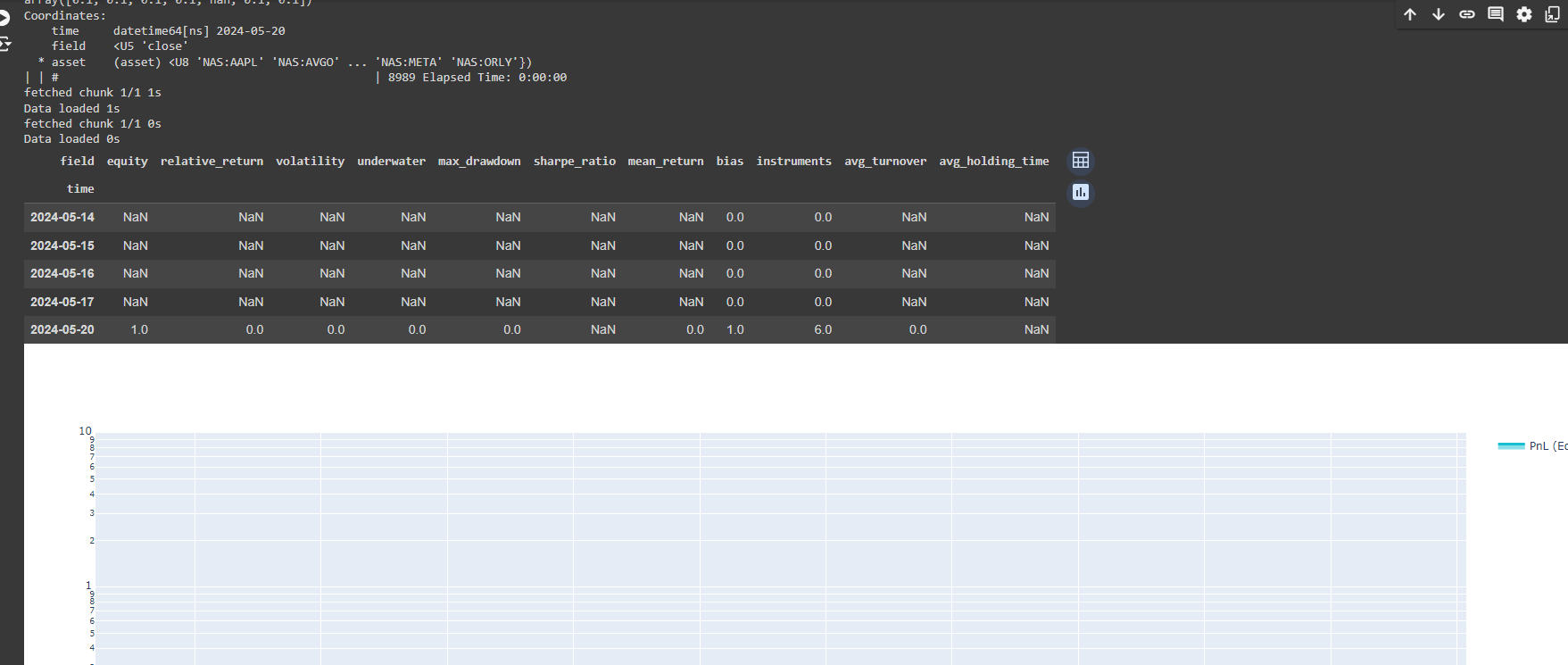

@vyacheslav_b Hello, I was trying the code you gave and realized that using state for train ml_backtest only works when the get feature function is a feature like ohlc or log of ohlc (open, high, low, close).

I added some other features (eg: trend = qnta.roc(qnta.lwma(data.sel(field='close'), 40), 1),...) and noticed that after passing ml_backtest, every The indexes are all nan. Looking forward to your help. Thank you.

-

@illustrious-felice Hello.

Show me an example of the code.

I don't quite understand what you are trying to do.

Maybe you just don't have enough data in the functions to get the value.

Please note that in the lines I intentionally reduce the data size to 1 day to predict only the last day.

last_time = data.time.values[-1] data_last = data.sel(time=slice(last_time, None))Calculate your indicators before this code, and then slice the values.

-

@vyacheslav_b Thank you for your response

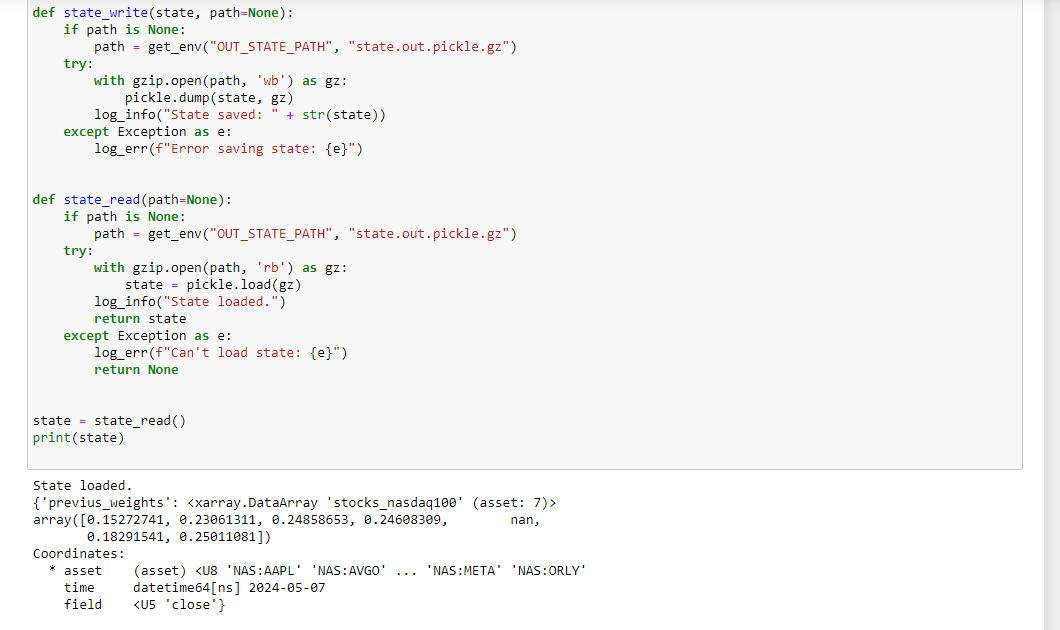

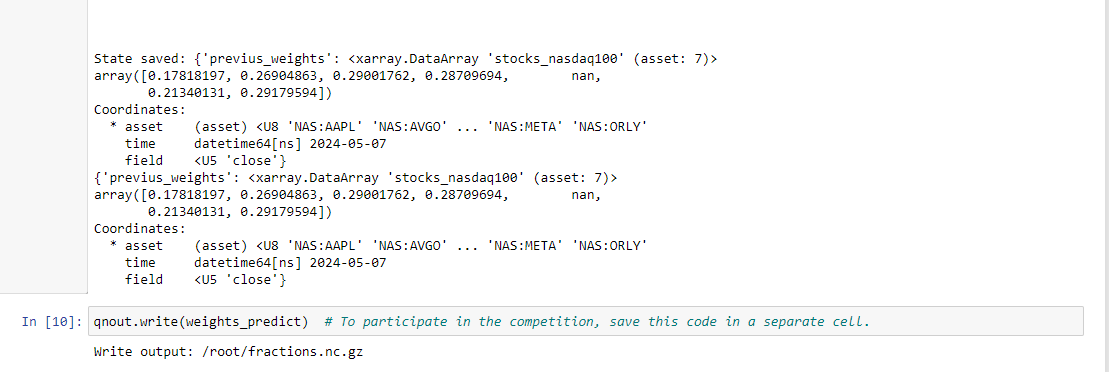

Here is the code I used from your example. I added some other features (eg: trend = qnta.roc(qnta.lwma(data.sel(field='close'), 40), 1),...) and noticed that after passing ml_backtest, every indexes are all nan. Pnl is a straight line. I have tried changing many other features but the result is still the same, all indicators are nanimport xarray as xr import qnt.data as qndata import qnt.backtester as qnbt import qnt.ta as qnta import qnt.stats as qns import qnt.graph as qngraph import qnt.output as qnout import numpy as np import pandas as pd import torch from torch import nn, optim import random asset_name_all = ['NAS:AAPL', 'NAS:GOOGL'] lookback_period = 155 train_period = 100 class LSTM(nn.Module): """ Class to define our LSTM network. """ def __init__(self, input_dim=3, hidden_layers=64): super(LSTM, self).__init__() self.hidden_layers = hidden_layers self.lstm1 = nn.LSTMCell(input_dim, self.hidden_layers) self.lstm2 = nn.LSTMCell(self.hidden_layers, self.hidden_layers) self.linear = nn.Linear(self.hidden_layers, 1) def forward(self, y): outputs = [] n_samples = y.size(0) h_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32) c_t = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32) h_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32) c_t2 = torch.zeros(n_samples, self.hidden_layers, dtype=torch.float32) for time_step in range(y.size(1)): x_t = y[:, time_step, :] # Ensure x_t is [batch, input_dim] h_t, c_t = self.lstm1(x_t, (h_t, c_t)) h_t2, c_t2 = self.lstm2(h_t, (h_t2, c_t2)) output = self.linear(h_t2) outputs.append(output.unsqueeze(1)) outputs = torch.cat(outputs, dim=1).squeeze(-1) return outputs def get_model(): def set_seed(seed_value=42): """Set seed for reproducibility.""" random.seed(seed_value) np.random.seed(seed_value) torch.manual_seed(seed_value) torch.cuda.manual_seed(seed_value) torch.cuda.manual_seed_all(seed_value) # if you are using multi-GPU. torch.backends.cudnn.deterministic = True torch.backends.cudnn.benchmark = False set_seed(42) model = LSTM(input_dim=3) return model def get_features(data): close_price = data.sel(field="close").ffill('time').bfill('time').fillna(1) open_price = data.sel(field="open").ffill('time').bfill('time').fillna(1) high_price = data.sel(field="high").ffill('time').bfill('time').fillna(1) log_close = np.log(close_price) log_open = np.log(open_price) trend = qnta.roc(qnta.lwma(close_price ), 40), 1) features = xr.concat([log_close, log_open, high_price, trend], "feature") return features def get_target_classes(data): price_current = data.sel(field='open') price_future = qnta.shift(price_current, -1) class_positive = 1 # prices goes up class_negative = 0 # price goes down target_price_up = xr.where(price_future > price_current, class_positive, class_negative) return target_price_up def load_data(period): return qndata.stocks.load_ndx_data(tail=period, assets=asset_name_all) def train_model(data): features_all = get_features(data) target_all = get_target_classes(data) models = dict() for asset_name in asset_name_all: model = get_model() target_cur = target_all.sel(asset=asset_name).dropna('time', 'any') features_cur = features_all.sel(asset=asset_name).dropna('time', 'any') target_for_learn_df, feature_for_learn_df = xr.align(target_cur, features_cur, join='inner') criterion = nn.MSELoss() optimiser = optim.LBFGS(model.parameters(), lr=0.08) epochs = 1 for i in range(epochs): def closure(): optimiser.zero_grad() feature_data = feature_for_learn_df.transpose('time', 'feature').values in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0) out = model(in_) target = torch.zeros(1, len(target_for_learn_df.values)) target[0, :] = torch.tensor(np.array(target_for_learn_df.values)) loss = criterion(out, target) loss.backward() return loss optimiser.step(closure) models[asset_name] = model return models def predict(models, data, state): last_time = data.time.values[-1] data_last = data.sel(time=slice(last_time, None)) weights = xr.zeros_like(data_last.sel(field='close')) for asset_name in asset_name_all: features_all = get_features(data_last) features_cur = features_all.sel(asset=asset_name).dropna('time', 'any') if len(features_cur.time) < 1: continue feature_data = features_cur.transpose('time', 'feature').values in_ = torch.tensor(feature_data, dtype=torch.float32).unsqueeze(0) out = models[asset_name](in_) prediction = out.detach()[0] weights.loc[dict(asset=asset_name, time=features_cur.time.values)] = prediction weights = weights * data_last.sel(field="is_liquid") # state may be null, so define a default value if state is None: default = xr.zeros_like(data_last.sel(field='close')).isel(time=-1) state = { "previus_weights": default, } previus_weights = state['previus_weights'] # align the arrays to prevent problems in case the asset list changes previus_weights, weights = xr.align(previus_weights, weights, join='right') weights_avg = (previus_weights + weights) / 2 next_state = { "previus_weights": weights_avg.isel(time=-1), } # print(last_time) # print("previus_weights") # print(previus_weights) # print(weights) # print("weights_avg") # print(weights_avg.isel(time=-1)) return weights_avg, next_state weights = qnbt.backtest_ml( load_data=load_data, train=train_model, predict=predict, train_period=train_period, retrain_interval=360, retrain_interval_after_submit=1, predict_each_day=True, competition_type='stocks_nasdaq100', lookback_period=lookback_period, start_date='2006-01-01', build_plots=True )

-

hello again to all,

I hope everyone is fine.

I again came across a question, which should have occurred to me earlier, namely when we use a stateful machine learning strategy for submission, how can we pass on the states without using the ml_backtester, assuming the notebook is rerun at each point in time.

Thank you.

Regards -

https://github.com/quantiacs/strategy-ml_lstm_state/blob/master/strategy.ipynb

This repository provides an example of using state, calculating complex indicators, dynamically selecting stocks for trading, and implementing basic risk management measures, such as normalizing and reducing large positions. It also includes recommendations for submitting strategies to the competition.

-

Hi @vyacheslav_b,

I just quickly checked the template and it seems to be very helpful.

Thx a lot for the update!

Regards -

This post is deleted! -

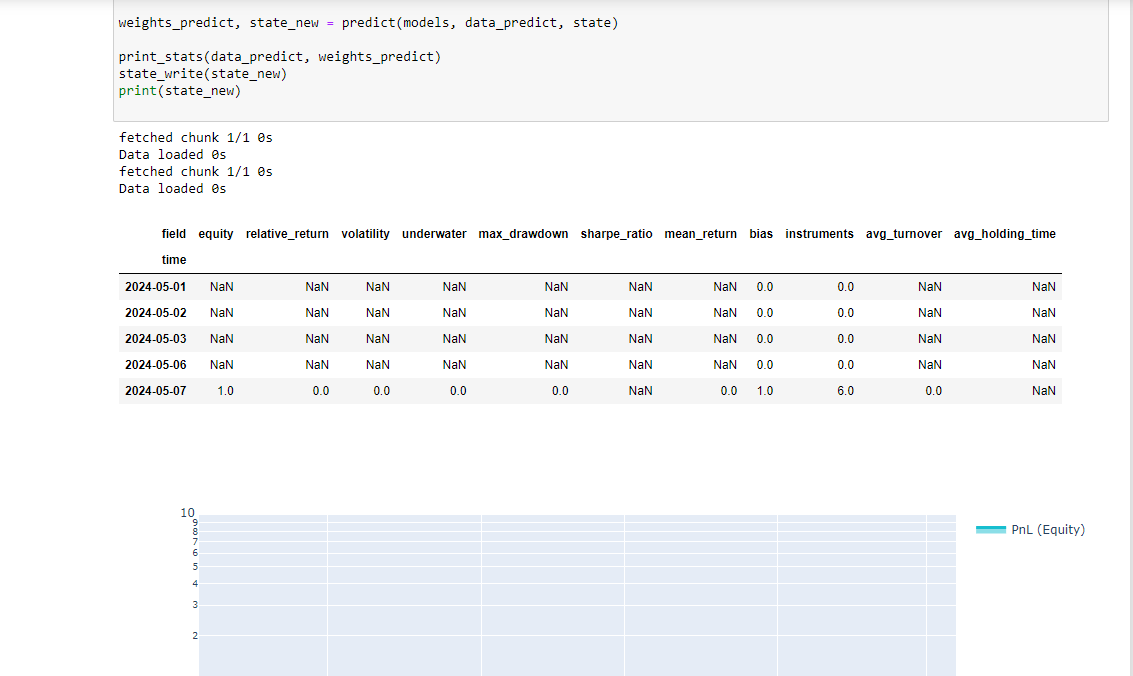

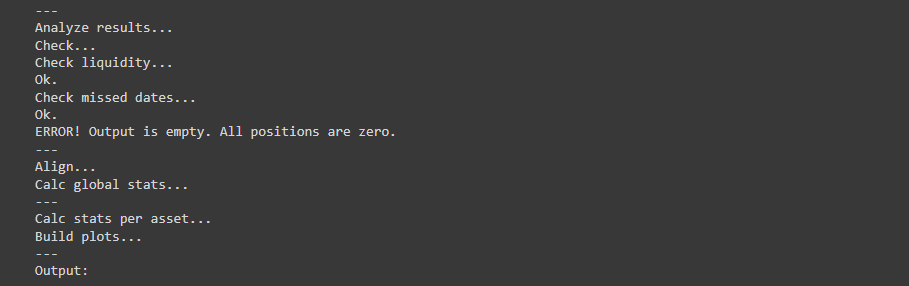

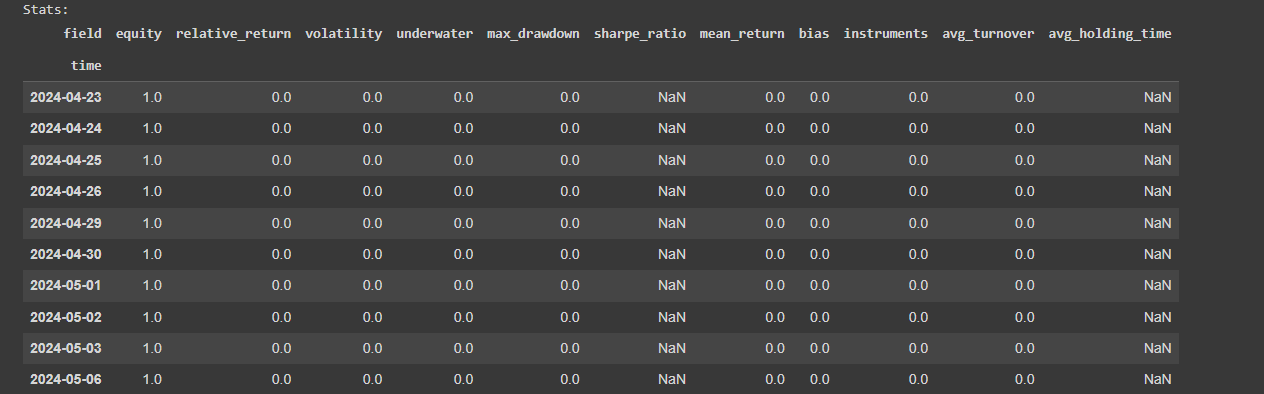

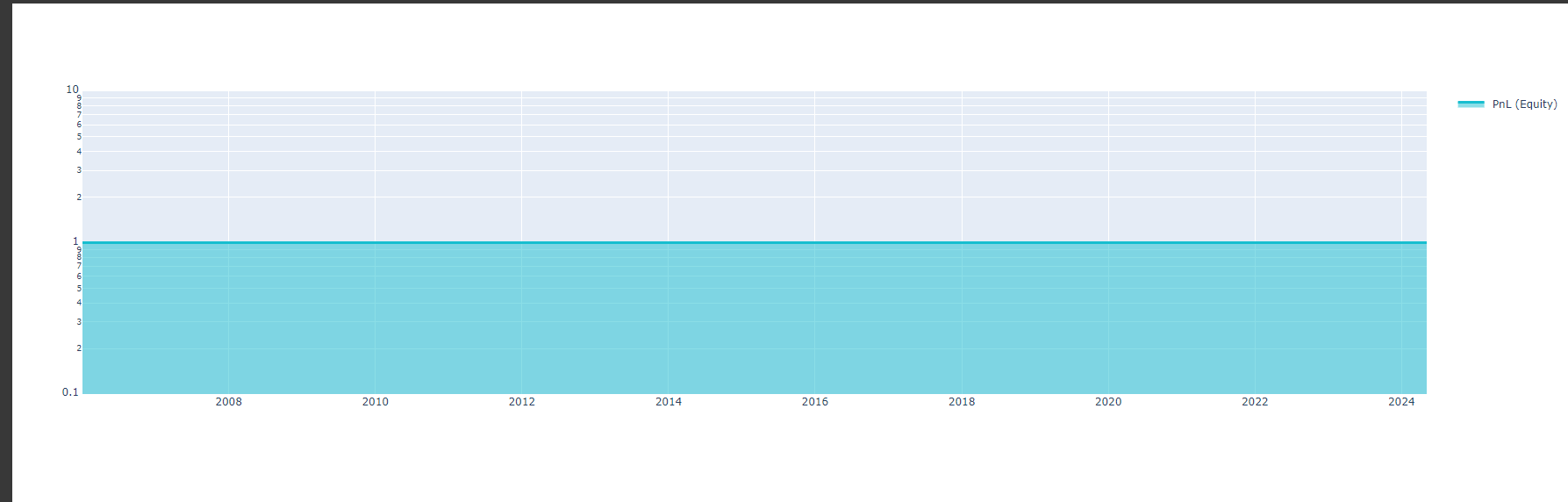

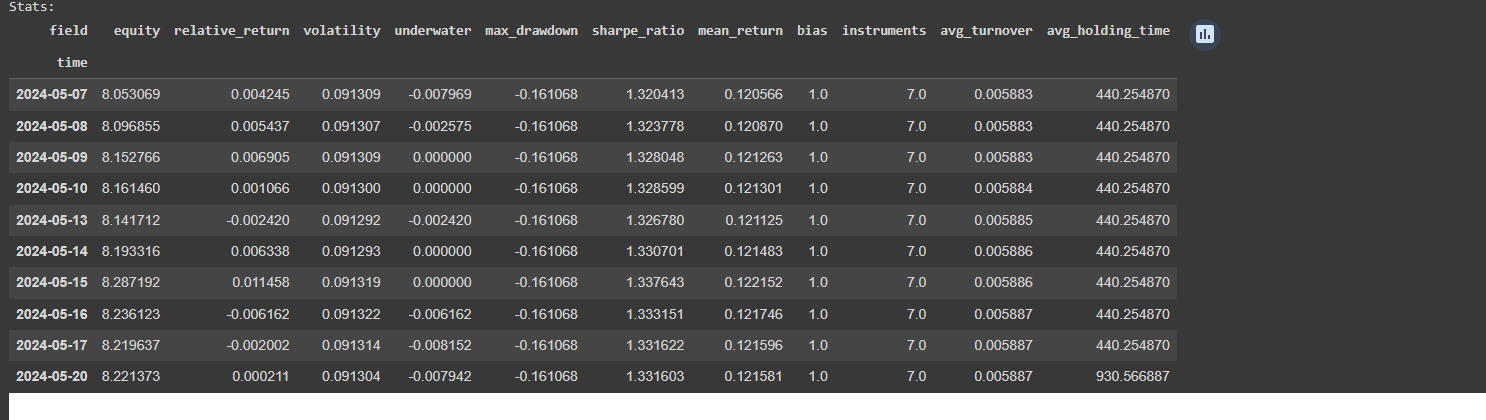

@Vyacheslav_B Hi, I just tried both ml backtest and single backtest. This is the ml_backtest result

However, when adding the single cell backtest after ml_backtest, the result is Nan, so how can I submit the strategy according to the single backtest? Looking forward to your answer. Thank you.

-

@machesterdragon Hello. I have already answered this question for you. see a few posts above.

Single-pass Version for Participation in the Contest

This code helps submissions get processed faster in the contest. The backtest system calculates the weights for each day, while the provided function calculates weights for only one day. -

@vyacheslav_b Hello. I would like to ask if Quantiacs provides any examples of using reinforcement learning or deep reinforcement learning models? Thank you.

-

@blackpearl Hello. I don’t use machine learning in trading, and I don’t have similar examples. If you know Python and know how to develop such systems, or if you use ChatGPT (or similar tools) for development, you should not have difficulties modifying existing examples. You will need to change the model training and prediction functions.

One of the competitive advantages of the Quantiacs platform is the ability to test machine learning models from a financial performance perspective.

I haven’t encountered similar tools. Typically, models are evaluated using metrics like F1 score and cross-validation (for example, in the classification task of predicting whether the price will rise tomorrow).

However, there are several problems:

- It is unclear how much profit this model can generate. In real trading, there will be commissions, slippage, data errors, and the F1 score doesn’t account for these factors.

- It is possible to inadvertently look into the future. For instance, data preprocessing techniques like standardization can leak future information into the past. If you subtract the mean or maximum value from each point in the time series, the maximum value reached in 2021 would be known in 2015, which is unacceptable.

The Quantiacs platform provides a tool for evaluating models from a financial performance perspective.

However, practice shows that finding a good machine learning model requires significant computational resources and time for training and testing. My results when testing strategies on real data have not been very good.