Local development of trading strategies¶

Using a Conda Environment¶

The Quantiacs library (QNT) is optimized for local strategy development. We recommend using Conda for its stability and ease of managing dependencies.

Setup Instructions¶

You can follow these easy steps and create an isolated environment on your machine using conda for managing dependencies and avoiding conflicts:

Install Anaconda: Download and install Anaconda from Anaconda’s official site.

Tip: Anaconda comes pre-loaded with all the packages. If you want a smaller footprint on your system, you can use Miniconda instead.

Create a QNT Development Environment:

Open your terminal and run:

conda create -n qntdev -c conda-forge 'python>=3.11,<3.14' 'ipywidgets=8.1.7' 'nbformat>=5.10.4' ipykernel ta-lib 'quantiacs-source::qnt' dash conda activate qntdev

Optional: Prevent auto-activation of this environment:

conda config --set auto_activate_base false

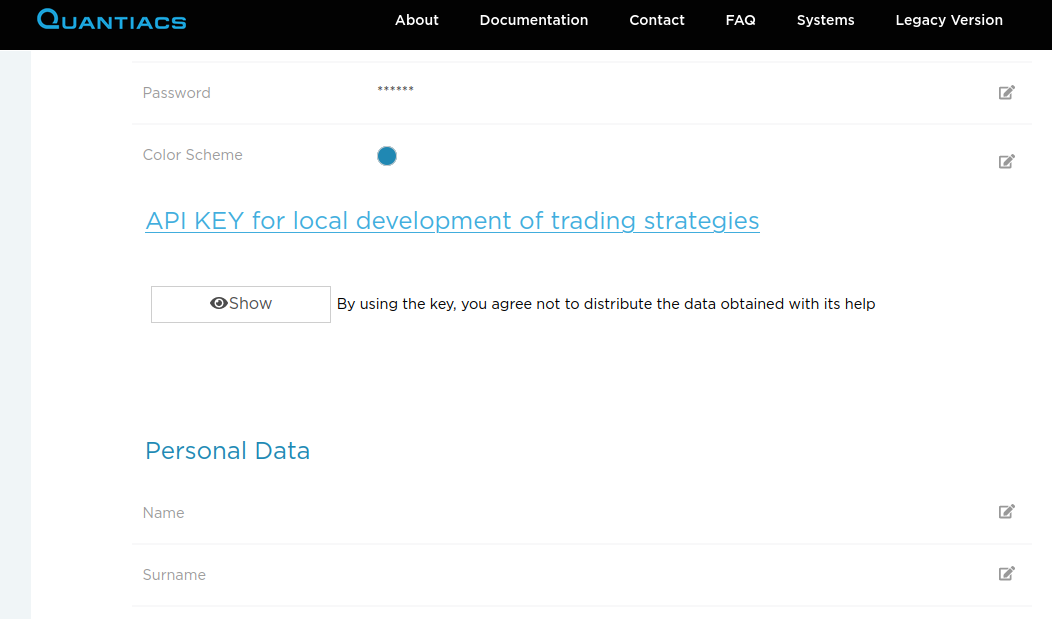

API Key Configuration:

Retrieve your API key from your Quantiacs profile.

Set the API key in your environment:

conda env config vars set -n qntdev API_KEY={your_api_key_here}

Alternatively, set the API key in your code (useful for IDE compatibility issues):

import os os.environ['API_KEY'] = "{your_api_key_here}"

Using the Environment:

Activate the environment with:

conda activate qntdev

Deactivate when done using:

conda deactivateAlways reactivate when returning to development.

Strategy Development:

Develop in your preferred IDE.

For Jupyter notebook usage:

jupyter notebook

Contest Participation:

Develop and test your strategy, then submit it to Quantiacs contests.

Updating the conda environment¶

Regularly update the QNT library for the latest features and fixes:

## you can remove the old one before that

# conda remove -n qntdev quantiacs-source::qnt

conda install -n qntdev quantiacs-source::qnt

You can see the library updates here.

Pip Environment¶

Note: While Conda is recommended, Pip can also be used, especially if Conda is not an option.

This one-liner combines the installation of Python, creation of a virtual environment, and installation of necessary libraries.

Single Command Setup¶

One Command Setup:

Ensure you have

pyenvandpyenv-virtualenvinstalled.Run the following command in your terminal:

pyenv install 3.11.13 && \ pyenv virtualenv 3.11.13 name_of_environment && \ pyenv local name_of_environment && \ python -m pip install 'ipywidgets==8.1.7' 'nbformat>=5.10.4' dash ipykernel git+https://github.com/quantiacs/toolbox.git

This command will:

Install Python 3.10.13.

Create a virtual environment named

name_of_environment.Activate the environment for the current directory.

Install the Quantiacs toolbox and other necessary Python libraries.

TA-Lib Installation:

The TA-Lib library may need to be installed separately due to its specific installation requirements.

Setting the API Key:

Set the Quantiacs API key in your code:

import os os.environ['API_KEY'] = "{your_api_key_here}"

Replace

{your_api_key_here}with the actual API key found in your Quantiacs profile.

Updating the pip environment¶

Use this command in your environment to install the latest version from the git repository:

python -m pip install --upgrade git+https://github.com/quantiacs/toolbox.git

Google Colab support¶

If you want to use Google Colab with a hosted runtime, start with this notebook.

This notebook contains the necessary commands to configure a hosted runtime.

If you use colab with a local runtime, then you can use regular conda environment. Go to the head of this page and follow the instructions for conda.

Working example Jupyter Notebook or Jupyter Lab¶

You can open any strategy on Quantiacs and check dependencies.

Launch Jupyter: Start Jupyter Notebook or Jupyter Lab.

Open a Strategy File: Load any

.ipynbstrategy file.List Dependencies: Execute

!conda listin a notebook cell to display installed packages.Review Dependencies: Ensure all required dependencies for your strategy are present and up-to-date.

This quick check aids in maintaining a robust environment for your Quantiacs trading strategies.

How to Check the qnt Library¶

Using the Quantiacs (qnt) library involves a few basic steps to create and run a trading strategy. Here’s a guide on how to do it:

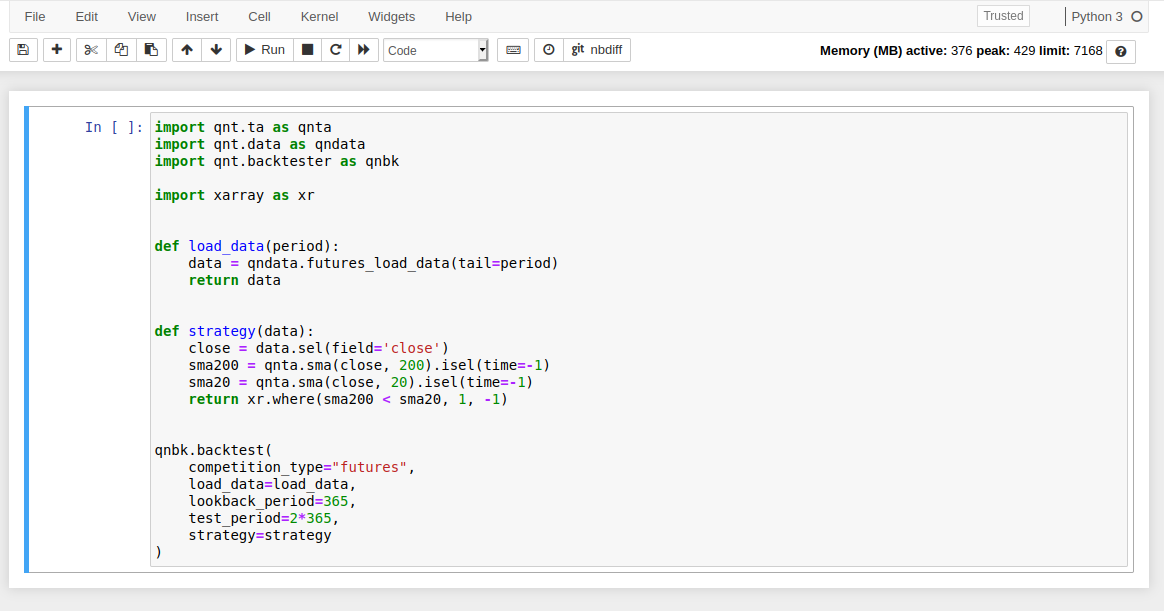

Step 1: Create a Strategy¶

The first step in utilizing the qnt library is to define your trading strategy. An example of a simple strategy is

provided below in the strategy.py file. This example demonstrates a basic long-short trading strategy based on the

crossing of two simple moving averages (SMAs) with lookback periods of 20 and 200 trading days.

Example Strategy: Simple Moving Average Crossover¶

The following Python code illustrates a straightforward implementation of a trading strategy using the qnt library:

# import os

#

# os.environ['API_KEY'] = "{your_api_key_here}"

import qnt.ta as qnta

import qnt.data as qndata

import qnt.backtester as qnbk

import xarray as xr

def load_data(period):

data = qndata.futures_load_data(tail=period)

return data

def strategy(data):

close = data.sel(field='close')

sma200 = qnta.sma(close, 200).isel(time=-1)

sma20 = qnta.sma(close, 20).isel(time=-1)

return xr.where(sma200 < sma20, 1, -1)

qnbk.backtest(

competition_type="futures",

load_data=load_data,

lookback_period=365,

test_period=2 * 365,

strategy=strategy

)

Step 2: Run the Strategy Using the Command¶

After creating your strategy, the next step is to run it using the Python command line. To execute your strategy, you can use the following command in your Python environment:

python strategy.py

This command runs the strategy.py script, which contains the defined trading strategy and invokes the backtest function from the qnt library. It’s important to ensure that the Python environment where you run this command has the qnt library installed and is properly set up to access market data.

Executing and submitting your strategy:

When you finish with developing your strategy, you need to upload your code in the Jupyter Notebook environment on the Quantiacs webpage. There are 2 options:

a) Copy and paste your code inside the cell of a Jupyter Notebook:

b) Upload your python file (for example, strategy.py) in your Jupyter environment root directory and type in strategy.ipynb:

import strategy

Place the installation commands for external dependencies to init.ipynb.

Run all cells to test your strategy in the Jupyter Notebook. Fix the errors if it is necessary. It is a good idea to run the file precheck.ipynb.

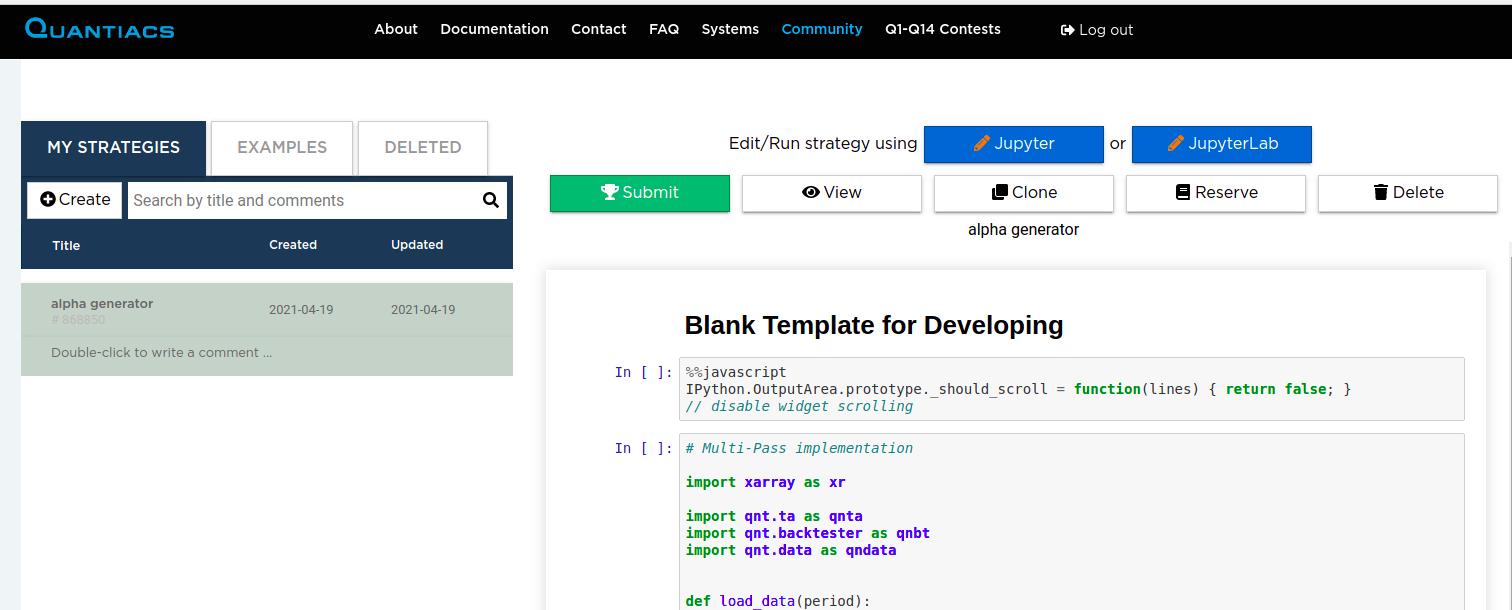

Send your strategy to the Contest from the Development area on your home page by clicking on the Submit button: