Competition filters¶

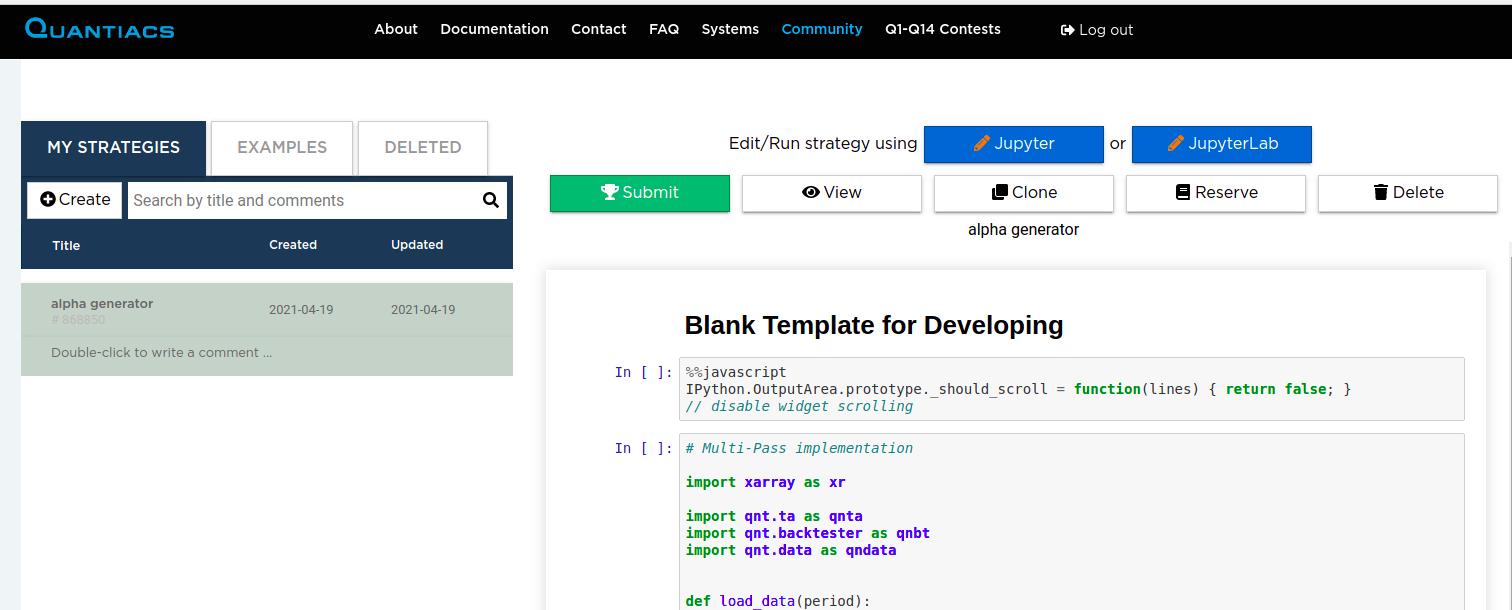

To submit a strategy for the contest, click on the Submit button in your Development area:

You also have the option to directly submit code from your development environment in Jupyter Notebook or JupyterLab.

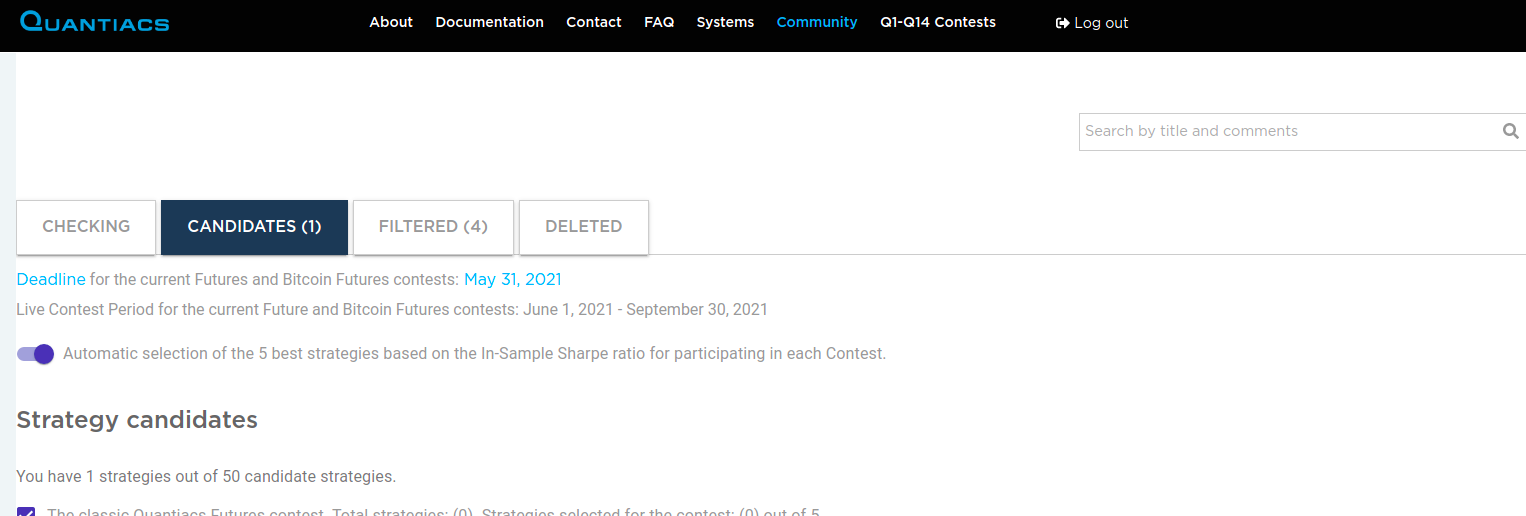

Upon submission, our servers will check your code. The status of this check will be displayed in the Competition section of your account, under the Checking tab:

If your algorithm passes these checks (filters), it will be admitted to the Contest and you can find it under the Candidates tab. If it fails these checks, it will be listed under the Filtered tab, where you can inspect the logs and understand the reason for the error.

Technical filters¶

Source file must exist¶

An error message stating that the strategy.ipynb file was not found is connected to a non-standard name for the file containing your strategy. This file must be named strategy.ipynb.

Execution failed¶

If you see an error message stating that the execution of strategy.ipynb failed, then you should check the logs as they will contain the necessary information.

You should check the logs (server logs and html columns) as they will contain the necessary information.

Pay special attention to the dates in the logs: you can use this information to reproduce the problem in the precheck.ipynb file you find in your root directory. Substitute these dates when calling evaluate_passes.

Weights must be written¶

If you see an error message stating that the call to the write_output function was skipped (example: Missed call to write_output), then your strategy does not save the final weights. Your last call in the strategy.ipynb file should be qnt.output.write(weights) (or qnt.backtest(…) if you use Multi-Pass Backtesting), assuming that you used weights for the final allocation weights.

qnt.output.write(weights)

All data must be loaded¶

An error message stating that data are loaded only until a certain day is due to the fact that you are loading the data cropping the number of days. Do not crop data when you submit, as your system needs to run on a daily basis on new data.

Error:

qndata.futures.load_data(min_date="2006-01-01", max_date="2008-01-01")

Solution

qndata.futures.load_data(min_date="2006-01-01")

Weights must be generated for all trading days¶

An error message stating that the strategy does not display weights for all trading days means that weights for some days are not generated, for example because of a drop operation. This problem can be avoided using the function qnt.output.check(weights, data, “futures”), assuming that you are working with futures and you are generating weights on data.

Weights are not generated at the beginning of the time series¶

Your strategy must produce non-zero weights starting from the date defined for each corresponding contest:

NASDAQ-100 Contest - Trading should begin from January 1, 2006.

Futures Contest - Trading should begin from January 1, 2006.

Bitcoin Futures - Trading should start from January 1, 2014.

Crypto Top-10 Long - Trading should commence from January 1, 2014.

To ensure compliance, review your strategy code:

Verify the data range being loaded. Define the appropriate time frame as follows:

futures = qndata.futures.load_data(min_date="2006-01-01")

Ensure the data range being saved:

display(weights) qnt.output.write(weights)

The Sharpe ratio’s computation period commences from the date when the first non-zero weights are identified. If, for instance, your algorithm begins generating weights on Bitcoin Futures from January 1, 2017, it will not be accepted because the In-Sample period is effectively too brief.

This issue often arises when utilizing technical analysis indicators which necessitate a warm-up period. You can check the date using:

min_time = weights.time[abs(weights).fillna(0).sum('asset')> 0].min()

min_time

The value of min_time should be equal to or later than the starting date specified in the rules for the respective competition.

If min_time is later than the starting date, it’s recommended to fill the starting values of the time series with non-zero values. For instance, you could use a simple buy-and-hold strategy.

def get_enough_bid_for(data_, weights_):

time_traded = weights_.time[abs(weights_).fillna(0).sum('asset') > 0]

is_strategy_traded = len(time_traded)

if is_strategy_traded:

return xr.where(weights_.time < time_traded.min(), data_.sel(field="is_liquid"), weights_)

return weights_

weights_new = get_enough_bid_for(data, weights)

weights_new = weights_new.sel(time=slice("2006-01-01",None))

For additional information regarding the calculation method, please refer to the source code of the library, specifically the qnt.output.calc_sharpe_ratio_for_check method.

Timeout¶

An error message stating that the strategy calculation exceeds a given time implies that you need to optimize the code and reduce the execution time. Futures systems should be evaluated in 10 minutes and Bitcoin futures/Crypto long systems in 5 minutes of time.

Number of strategies¶

An error message stating that the limit for strategies has been exceeded is connected to the number of running strategies in your area. You can have at most 50 of them and you should select 15 for the contest.

Templates¶

A copy of a template will NOT be eligible for a prize.