Financial data¶

Quantiacs provides historical data for the world’s major financial markets. Currently the dataset includes stocks, futures (including the Bitcoin futures) and cryptocurrencies. This section provides an overview of the data and a documentation for each set:

Stocks¶

Quantiacs provides historic, split adjusted, data for more than 250 stocks, all have been NASDAQ100 index constituents at some point from 2001. (the beginning of index membership data). Most of stocks from the set are still active, but part of them aren’t, and the main reason for keeping them still is to avoid survivorship bias occurrence.

Stocks list¶

For getting the list of available stocks, load_ndx_list() method is used. By default, without passing any argument, the method returns only the list of stock objects (dictionaries), which have been index members in last 4 years from now (default, tail=4*365). For filtering the list to some specific period, pass appropriate values to arguments:

min_date - filters the list from specific date (string, ‘yyyy-mm-dd’ format)

max_date - end date of a period, last date

tail - number of days to lookback in history from now (int)

So, call for stocks list of NASDAQ100 index members from 2006. will look:

import qnt.data as qndata

stocks_list = qndata.stocks.load_ndx_list(min_date='2006-01-01')

len(stocks_list)

231

stocks_list[:3]

[{'name': 'American Airlines Group',

'sector': 'Consumer Goods',

'symbol': 'AAL',

'exchange': 'NAS',

'id': 'NAS:AAL',

'FIGI': 'tts-67645939'},

{'name': 'Apple',

'sector': 'IT/Telecommunications',

'symbol': 'AAPL',

'exchange': 'NAS',

'id': 'NAS:AAPL',

'FIGI': 'tts-831814'},

{'name': 'Airbnb Inc',

'sector': None,

'symbol': 'ABNB',

'exchange': 'NAS',

'id': 'NAS:ABNB',

'FIGI': 'tts-207966789'}]

Additional information from the list can be used for further filtering, such as information of sector that certain stock belongs to. We can play around and create simple functions related to sectors, primarily to get the list of sectors:

def get_sectors():

return {x['sector'] for x in stocks_list}

get_sectors()

{'Commodities',

'Consumer Goods',

'Energy',

'Finance',

'Healthcare',

'IT/Telecommunication',

'Industry',

None,

'Utilities'}

or simply, to check stocks distribution between sectors:

def sector_distribution():

dist = dict()

for stock in stocks_list:

sector = stock["sector"]

if sector not in dist:

dist[sector] = 0

dist[sector] += 1

return dist

or just to get the list of symbols from specific sector:

def get_sector_stocks(sector):

return [x['id'] for x in stocks_list if x['sector'] == sector]

like “Energy” sector:

get_sector_stocks("Energy")

['NAS:AEP', 'NAS:EXC', 'NAS:FSLR', 'NAS:PTEN', 'NAS:XEL']

finally, output is passed further to specify the set of assets for which we want to obtain data, described in next section.

Load stocks dataset¶

For each stock got from stocks list, historical data can be obtained. We use load_ndx_data() method for loading the data, and the data could be time sliced by passing the same params as for load_ndx_list method (min_date, tail, max_date), but also can be reduced to return only data for particular assets (e.g. from certain sector).

import qnt.data as qndata

stocks_data = qndata.stocks.load_ndx_data(min_date='2006-01-01', dims=('time', 'field', 'asset'))

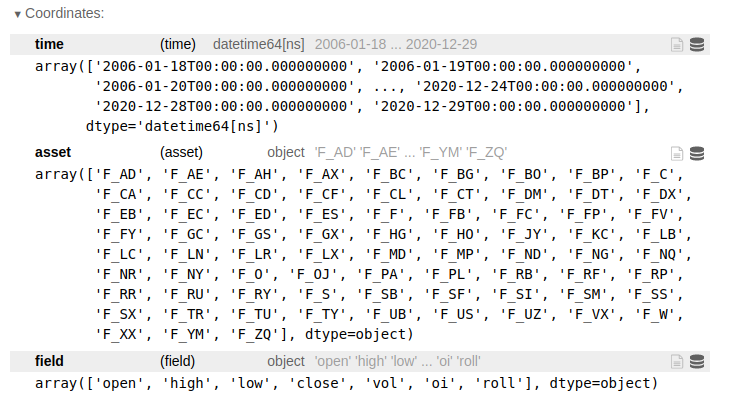

stocks_data is 3-dimenional xarray structure with coordinates:

time: series of dates in string format ‘yyyy-mm-dd’

asset: list of instruments in string format, combination of first 3 characters of stock exchange and ticker symbol

field: attribute in End of Day quality

| Data field | Description |

|---|---|

| OHLC | open, high, low, close daily price |

| vol | Daily trading volume (number of shares). |

| divs | Dividend payment |

| is_liquid | The asset is NASDAQ100 constituent at that moment |

Accessing specific field, timestamp or asset from stocks_data DataArray is possible with .sel method. Let’s say we want to use only Apple data from dataset:

aapl = stocks_data.sel(asset="NAS:AAPL")

### we can convert xarray.DataArray to pandas Dataframe

aapl.to_pandas()

For more about xarray please check User Guide xarray.

Data visualization¶

We can use Apple data already defined as aapl variable above, and create a plot for period 2015 - 2020, using plotly library:

aapl = aapl.sel(time=slice("2015-01-01", "2020-12-31")).to_pandas()

import plotly.graph_objs as go

from plotly.subplots import make_subplots

aapl_bars = make_subplots(specs=[[{"secondary_y": True}]])

aapl_bars.add_trace(go.Candlestick(x=aapl.index,

open=aapl['open'],

high=aapl['high'],

low=aapl['low'],

close=aapl['close'],

name='Price'))

aapl_bars.update_layout(xaxis_rangeslider_visible=False)

aapl_bars.show()

Futures¶

Quantiacs provides data for 78 liquid global futures contracts. The underlying assets are commodities (energy, metals, agricultural goods) and financial assets: stock indices, bonds and currency rates. In addition it provides the Bitcoin futures contract, whose history is extended back in time by patching the futures data with the Bitcoin spot data.

List of Futures¶

The information about available futures contracts can be obtained using:

import qnt.data as qndata

future_list = qndata.futures.load_list()

future_list

The command returns a list with all available futures contracts, with their identifying symbols and full names:

[{'id': 'F_AE',

'name': 'AEX Index',

'sector': 'Index',

'point_value': 'EUR 200'},

...,

{'id': 'F_ES',

'name': 'S&P 500 ETF TRUST ETF',

'sector': 'Index',

'point_value': '1'}]

Using the Data¶

Suppose that we want to use the data for the last 15 years. We can use:

import qnt.data as qndata

futures_data = qndata.futures.load_data(tail = 365*15, dims = ('time', 'field', 'asset'))

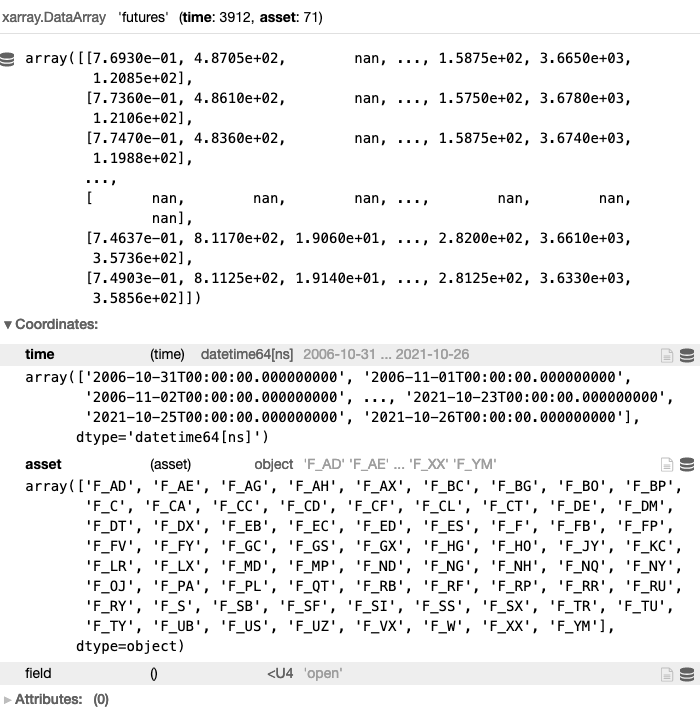

futures_data

The variable futures_data is an xarray.DataArray structure whose coordinates are:

time: a date in format yyyy-mm-dd;

asset: the identifying symbol for the asset, for example F_BP for the British Pound/US Dollar ratio.

field: an attribute, for example the opening daily price;

Specific fields are given by:

| Data field | Description |

|---|---|

| open | Opening daily price. |

| close | Closing daily price. |

| high | Highest daily price. |

| low | Lowest daily price. |

| vol | Daily trading volume (number of contracts). |

| oi | Total number of outstanding contracts. |

| roll | Futures contract rollover information. |

More details on xarray can be found at User Guide xarray

An example of accessing the daily open prices for each asset:

futures_data.sel(field='open')

All specific fields can be accessed this way.

Values for specific contracts can be obtained selecting the asset. Let us say we are interested in British pound futures. We can get the close price as follows:

GBP_USD = futures_data.sel(asset = 'F_BP').sel(field = 'close')

For a more detailed description on loading and accessing Futures data consult our API-Reference: Loading Futures Data

For visualizing the data we can use for example the plotly library https://plotly.com/:

import plotly.graph_objs as go

trend_fig = [go.Scatter(

x = GBP_USD.to_pandas().index,

y = GBP_USD,

line = dict(width=1, color='black'))]

fig = go.Figure(data = trend_fig)

fig.update_yaxes(fixedrange=False)

fig.show()

Using the BTC Futures¶

For a more detailed description on loading and accessing BTC Futures consult our API-Reference: Loading BTC Futures Data

The Bitcoin Futures data for the last 8 years (history extended with Bitcoin spot price) can be loaded using:

import qnt.data as qndata

btc_data = qndata.cryptofutures.load_data(tail = 365*8, dims = ('time', 'field', 'asset'))

Front Contracts and Different Maturity Contracts¶

As several Futures contracts with the same underlying instrument but different expiration dates (maturities) are traded on financial exchange at the same time, we provide the option to load continuous front contracts (closest expiration date), next-to-front contracts (next-to-closest expiration date) and next-to-next-to-front contracts (next-to-next-to-closest expiration date):

front_data = qndata.futures.load_data(min_date='1900-01-01', offset=0)

next_to_front_data = qndata.futures.load_data(min_date='1900-01-01', offset=1)

next_to_next_to_front_data = qndata.futures.load_data(min_date='1900-01-01', offset=2)

Note that the default choice (no offset specified) selects front contracts. All three options are continuous contracts, obtained by patching together the single Futures contracts.

All three continuous contracts can be used as indicators, but only the front contracts will be used for the backtesting and real trading.

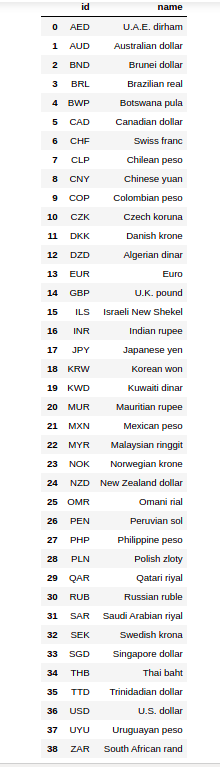

Spot Currency Data¶

Currency rates taken from the International Monetary Fund page can be inspected using:

import pandas as pd

import qnt.data as qndata

currency_list = qndata.imf_load_currency_list()

pd.DataFrame(currency_list)

which returns the list for 39 time series:

Data for each time series can be loaded using (for example last 5 years):

euro_currency = qndata.imf_load_currency_data(assets=['EUR'], tail=365 * 5)

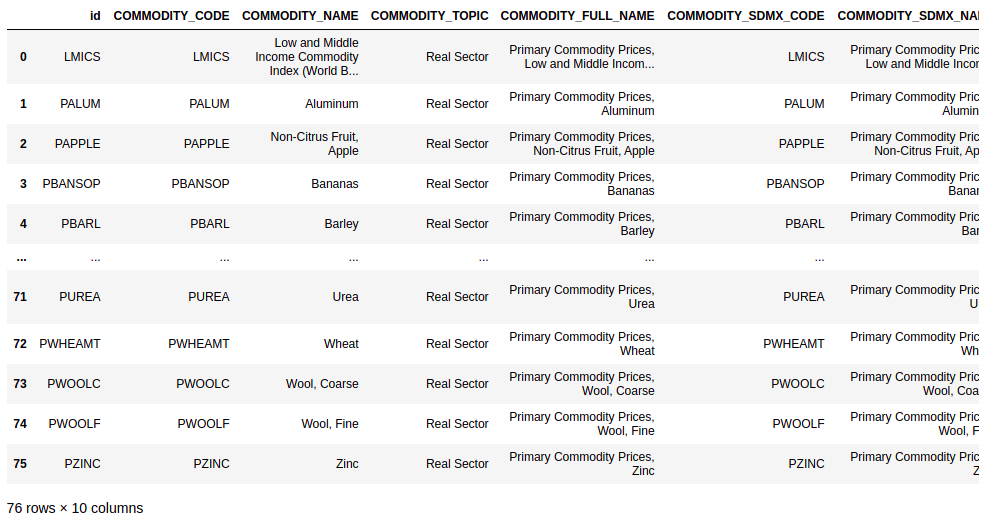

Spot Commodity Data¶

Commodity data taken from the International Monetary Fund page can be inspected using:

import pandas as pd

import qnt.data as qndata

commodity_list = qndata.imf_load_commodity_list()

pd.DataFrame(commodity_list)

which returns the list for 76 time series:

Data for each time series can be loaded using (for example last year):

gold = qndata.imf_load_commodity_data(assets=['PGOLD'], tail=365)

Cryptocurrencies¶

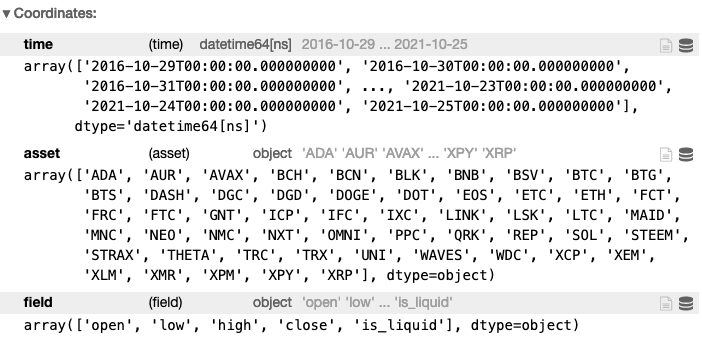

Cryptocurrency Daily Data¶

Quantiacs provides up-to-date daily data for 54 cryptocurrencies:

['ADA', 'AUR', 'AVAX', 'BCH', 'BCN', 'BLK', 'BNB', 'BSV', 'BTC', 'BTG',

'BTS', 'DASH', 'DGC', 'DGD', 'DOGE', 'DOT', 'EOS', 'ETC', 'ETH', 'FCT',

'FRC', 'FTC', 'GNT', 'ICP', 'IFC', 'IXC', 'LINK', 'LSK', 'LTC', 'MAID',

'MNC', 'NEO', 'NMC', 'NXT', 'OMNI', 'PPC', 'QRK', 'REP', 'SOL', 'STEEM',

'STRAX', 'THETA', 'TRC', 'TRX', 'UNI', 'WAVES', 'WDC', 'XCP', 'XEM',

'XLM', 'XMR', 'XPM', 'XPY', 'XRP']

The available cryptocurrency data for the last 5 years can be loaded using:

import qnt.data as qndata

crypto_data = qndata.cryptodaily.load_data(tail = 365 * 5)

For each cryptocurrency data is available on an daily resolution. crypto_data is an xarray.DataArray structure whose coordinates are:

time: a date-time in format yyyy-mm-dd;

asset: the identifying symbol for the asset, for example ETH for Ethereum.

field: an attribute, for example the opening hourly price;

Specific fields are given by:

| Data field | Description |

|---|---|

| open | Opening daily price. |

| close | Closing daily price. |

| high | Highest daily price. |

| low | Lowest daily price. |

| is_liquid | Is this cryptocurrency liquid? |

For a more detailed description on loading and accessing Crypto Daily data consult our API-Reference: Loading Crypto Daily Data

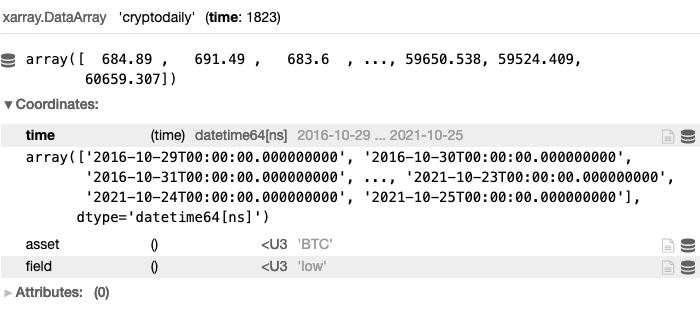

Let us say we are interested in the lowest daily price for BTC. We can extract it using:

crypto_data.sel(field = 'low').sel(asset = 'BTC')

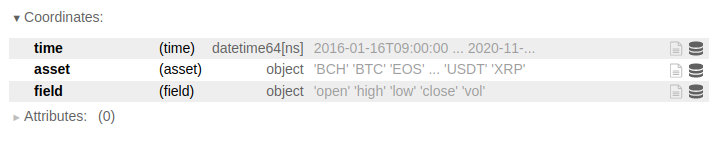

Cryptocurrency Hourly Data¶

Quantiacs provides up-to-date hourly data - price and volume - for the following cryptocurrencies:

Bitcoin (BTC);

Bitcoin Cash (BCH);

EOS;

Ethereum (ETH);

Litecoin (LTC);

Ripple (XRP);

Tether (USDT).

The available cryptocurrency data for the last 5 years can be loaded using:

import qnt.data as qndata

crypto_data = qndata.crypto.load_data(tail = 365 * 5)

For each cryptocurrency data are available on an hourly resolution. crypto_data is an xarray.DataArray structure whose coordinates are:

time: a date-time in format yyyy-mm-ddTHH-MM-SS;

asset: the identifying symbol for the asset, for example ETH for Ethereum;

field: an attribute, for example the opening hourly price;

Specific fields are given by:

| Data field | Description |

|---|---|

| open | First price in a given hour. |

| close | Last price in a given hour. |

| high | Highest price in a given hour. |

| low | Lowest price in a given hour. |

| vol | Hourly trading volume. |

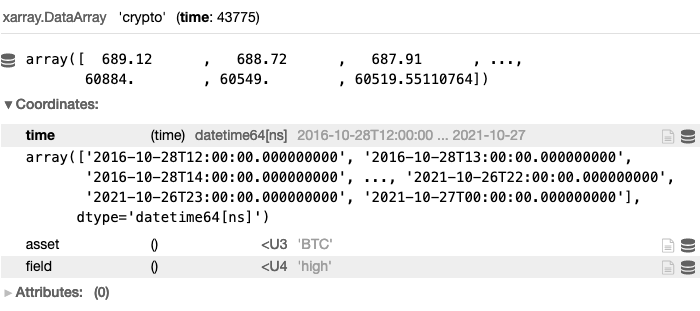

Let us say we are interested in the highest hourly price for BTC. We can extract it using:

BTC_high = crypto_data.sel(field = 'high').sel(asset = 'BTC')

BTC_high

The BTC_high data can then be visualized using:

import plotly.graph_objs as go

trend_fig = [go.Scatter(

x = BTC_high.to_pandas().index,

y = BTC_high,

line = dict(width=1,color='black'))]

fig = go.Figure(data = trend_fig)

fig.update_yaxes(fixedrange=False)

fig.show()

For a more detailed description on loading and accessing Crypto Hourly data consult our API-Reference: Loading Crypto Hourly Data